Buy Bajaj Finance Ltd For Target Rs. 9,200 By Yes Securities Ltd

Resilience of Growth and RoE

Strong growth underpinned by resilient asset quality and stable margins

BAF delivered a small beat on our consolidated PAT estimate of Q3 FY25, wherein the strong AUM growth (6.5% qoq/28% yoy) was driven by stable NIM (steady CoF & Yield) and resilience in asset quality (Stage-2/Stage-3 increase of 2%/12% qoq). Relatively higher flows (though in-line with portfolio growth) in the initial delinquency buckets were seen in product segments of Urban/Rural Sales Finance, Urban B2C and Used Car Loans. Rural B2C and SME/Commercial segments witnessed an improvement in asset quality. Overall credit cost at annualized 2.16% was very close to Q2 FY25 level. AUM growth in Q3 FY25 was driven by Urban/Rural Sales Finance, Urban/Rural B2C, SME/Commercial and the newer segments of Gold Loans and Car Loans. The 2w/3w portfolio declined with Bajaj Auto starting its own captive financing. The new loan bookings and customer addition were the highest ever in any quarter at 12.1mn (up 22% yoy) and 5mn respectively. Optimization of opex and calibrated employee addition (improving productivity) underpinned a controlled cost growth and sustained gradual improvement in Opex/AUM. Notwithstanding some challenges in macro, BAF continues to deliver strong RoE of 19%+.

Expects a gradual decline in credit cost and sustained strong growth

Management estimates a credit cost of 2-2.05% in Q4 FY25 (10-15 bps lower qoq) with encouraging improvement in collection/flows seen in Dec-Jan across many products. Key product-level asset quality comments made by the management were 1) portfolio trends in both Urban and Rural Sales Finance remains strong, 2) collections/flows have improved in Rural B2C, 3) default rates are lower in Urban B2C but collections/flows are yet to normalize, 4) after being impacted in April-Oct, the collection efficiency markedly improved in Nov-Dec in SME lending and 5) asset quality remains a challenge in used car refinancing. BAF is confident that credit cost would be below 2% in FY26 with likely further improvement in delinquency trends at product/segment level (proactive risk actions taken) and increase in the share of secured products. In personal loans (Urban/Rural B2C), the co. has significantly reduced disbursement/onboarding share of customers having 3 or more live unsecured loans and hopes to exit the fiscal with around pre-covid level of 5-7%.

Retain BUY on supportive valuation and expectations of earnings growth acceleration

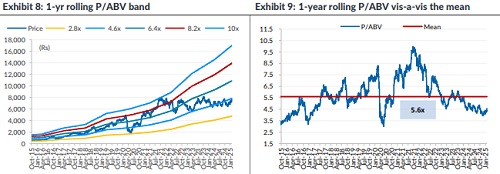

With emerging trends of improvement in credit cost, the growth and RoE outlook has become stronger. On consolidated basis, we expect BAF to deliver 27% earnings growth on 25% AUM growth over FY25-27 with avg RoA/RoE of 4.1%/21.5%. BAF has exhibited resilience in growth and profitability through various phases of competition, credit cycles and liquidity conditions. Stock is trading at palatable valuation of 17.5x PE and 3.6x P/BV on FY27 estimates. We retain BUY with enhanced 12m PT of Rs9200.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632