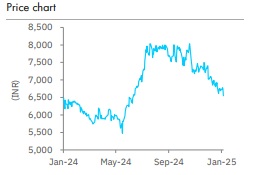

Accumulate Atul Ltd For Target Rs. 7,129 By Elara Capital Ltd

Margin pressure QoQ

Atul (AUTL IN) stock has corrected 14% in the past three months. It is in line with most chemicals sector stocks that have underperformed the Nifty Midcap Index, which fell a mere 5%, due to continued oversupply from China and weak commentary from major global firms regarding demand recovery, already reflected via a weak margin environment. Global chemicals majors expect weak demand growth across most products and the challenging pricing environment at least until H1CY25. Therefore, we remain cautious on the chemicals sector. We reiterate Accumulate with a lower TP to INR 7,129 based on a DCF method.

Earnings decline QoQ due to weakness in performance & other chemicals margin:

ATLP reported an EBITDA of INR 2.2bn and a PAT of INR 1.1bn in Q3FY25 vs our estimates of INR 1.6bn and INR 0.8bn, up 48% YoY & 53% YoY, respectively, due to the base effect of weakening in revenue and EBIT margin of the life sciences segment in Q3FY24. However, EBITDA fell 8% QoQ and PAT by 21% QoQ, due to the decline in EBIT margin of the performance & other chemical (POC) segment. Consequently, EBITDA margin improved to 15.8%, up 248bp YoY but down 161bp QoQ, vs our estimate of 13.1%.

Performance & other chemicals growth QoQ led by polymers:

The POC segment comprising 71% of revenue and 43% of EBIT saw an EBIT margin of 7.2% in Q3FY25 from 7.8% in Q3FY24 and 9.7% in Q2FY25. Although segment-wise revenue was up 24% YoY and 2% QoQ, segment EBIT fell 24% QoQ and up 15% YoY. As per commentary of major chemicals firms globally, sulphones demand decreased in all regions except China, which has hit realization. Demand is set to be on a gradual recovery trend.

Life science chemicals margin expands:

Revenue from the life science chemicals segment, comprising 28% of revenue and 55% of EBIT, grew 23% YoY & 2% QoQ. The segment’s EBIT margin was 23.0% in Q3FY25 from 12.6% in Q3FY24 and 20.5% in Q2FY25. Improved segment-wise performance in 9MFY25 was on account of better demand from end-user industries, such as pharma & personal care and higher exports demand for crop protection. As per commentary of major global firms, there is lower channel inventory in both North America and the EU, and it expects normal buying behaviour; hence, H1CY25 for agrochemicals will be stronger than in H1CY24.

Reiterate Accumulate with a lower TP to INR 7,129:

We reiterate Accumulate on expectations of gradual agrochemicals & aromatics demand recovery in FY26, but it remains cautious on price recovery due to China’s oversupply based on commentary of major firms globally. We decrease our EPS by 5% each for FY26E and FY27E on lower EBIT margin on slower price recovery expectations. Consequently, we lower our DCFbased TP to INR 7,129 from INR 8,340, assuming a 5.0% (unchanged) terminal growth rate, a 10.8% (unchanged) cost of capital, an average EBITDA margin of 15.7% (from 17.0%) during FY25-47E with a revenue CAGR of 13.1% during FY24-47E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933