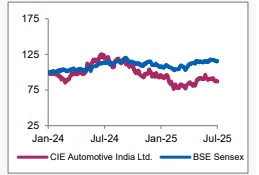

Buy CIE Automotive India Ltd For Target Rs. 465 by Axis Securities Ltd

Near-Term Pressure Persists; Long-Term Fundamentals Intact

Est. Vs. Actual for Q2CY25: Revenue – INLINE; EBITDA – MISS ; PAT – MISS

Change in Estimates post Q2CY25

CY25E/CY26E: Revenue: -0.8%/-0.8%; EBITDA: -4%/0.5; PAT: -1.9%/1.8%

Recommendation Rationale

• Strong Order Book Momentum Reflects Underlying Demand Strength: CIE Automotive India continues to win significant new business, with H1CY25 order inflow reaching Rs 600 Cr (vs Rs 350 Cr in Q1). This reflects healthy customer engagement and strong traction for its engineering capabilities across iron castings, gears, EV and other precision components.

• Strategic Product Development Enhances Competitive Edge in High-Precision Segments: The company has scaled up new product development across key verticals – including two-wheeler crankshafts (predominantly for Royal Enfield), common rail systems and high-precision EV gears. These innovations cater to advanced manufacturing requirements and support both volume growth and higher margin realisation, especially in EV-specific components.

• Exports & Commercial Engagements Gaining Traction: With enhanced focus on exportoriented products such as iron castings and gears, and the appointment of a new Business Development Head in India, the company is actively strengthening commercial ties with global clients. Export momentum is expected to pick up significantly from early next year, aiding margin and topline growth

Company Outlook & Guidance: The management indicated that the Indian business will continue to perform better than the industry average in the medium term, with European businesses expected to recover post CY26 gradually.

Current Valuation: 1-year forward 22xPE on Indian and 8x PE (unchanged) on European CY26 EPS

Current TP: Rs 465/share (unchanged),

Recommendation: We maintain our BUY rating on the stock.

Financial Performance

CIEAUTO’s Q2CY25 consolidated revenue grew by 3.3% YoY and 4.2% QoQ, in line with expectations. EBITDA declined by 6.5% YoY but remained flat QoQ, missing our estimates by 4% due to an unfavourable product mix in the Indian business, higher-than-anticipated personnel costs, and one-time restructuring expenses at Metalcastello, Europe. Reported PAT stood at approximately Rs 203 Cr, down 6% YoY and 1.5% QoQ, primarily tracking the EBITDA decline and missing our estimates by 7% due to lower-than-expected other income.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)