Add Allied Blenders & Distillers Ltd for the Target Rs. 590 by Choice Broking Ltd

Business Overview

ABDL, founded in 1988, is a leading player in Indian-made Foreign Liquor (IMFL) market. Its flagship product, Officer’s Choice Whisky, launched in 1987, is the third best-selling Whisky worldwide, with sales of 22.6Mn cases. The company is focused on premiumization, recently introducing its super-premium Gin, Zoya and acquiring brands, such as Rock Paper Rum and Woodburns, to enhance its portfolio. On the operational side, ABDL is implementing backward integration, targeting 100% in-house production of Extra-neutral Alcohol (ENA) and malt

What are ABDL’s plans to expand into the luxury AlcoBev market?

* In Q1FY26, the P&A portfolio showed 46.9% volume growth; its contribution rose to 46.2% (volume) and 55.8% (value), up from 36.9% and 46.1%, reflecting ongoing portfolio premiumization.

* ABDL has partnered with the superstar Ranveer Singh for ‘ABDL Maestro,’ which will spearhead the company’s Luxury and Super Premium offering as they scale up over the next 3 years.

* The upcoming malt plant, with a capacity of ~4 MLPA, will become a crucial factor in the final flavour, taste, and success of this strategic play.

What does ABDL’s distribution network look like?

* Domestic Presence: ABDL is one of the four companies to have a pan-India distribution network. ABDL has access to ~80k retail touchpoints (~80% of the total PoS), which becomes a critical factor for availing the benefits of distribution efficiency.

* Exports: With an export revenue share of 5% and exposure to 23 countries, ABDL is placed perfectly for the spurt in premium brands’ volumes.

What is the expected margin and how will it improve?

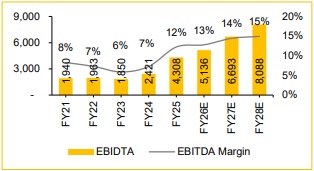

* The vendor rate reset carried out after the IPO boosted margin significantly by ~500 bps in FY25; EBITDA Margin of which was 12.2%.

* The acquisition of the distillery in Maharashtra, malt plant activation and further upgrades to PET bottle manufacturing will further improve the margin.

* We expect ABDL to achieve industry parity EBITDA margin of 14.9% by FY28E.

Why invest in ABDL?

* We believe the growth of new brands is not seeing a fair appreciation in terms of their market price. These brands have a potential revenue growth CAGR of 15%, with added optionality for Indian Single Malt kicking in over the next 1–2 years.

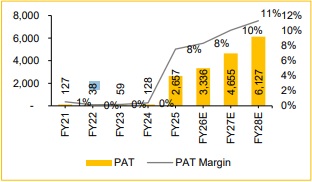

* Further, as the vertical integration is completed, there is an expected margin expansion of 300bps over the next 3 years, leading to a net income CAGR of 32.1%.

* Additionally, we believe lower interest cost owing to reduction in debt will boost profitability at Net Income level.

Recommendation: We currently have an ‘ADD’ rating on the stock with a target price of INR 590.

Key Risks:

* Brands launches may possibly fail to gain volume and market share: ABDL launched several brands in new categories and at heightened price points.

* Delay in plant setup can lead to lower EBITDA Margin: The backward integration strategy will play out only on the strength of the new integrated plants coming online as per the established timelines.

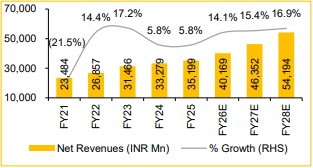

We expect 11.8% CAGR for revenues FY25-FY28E

Premiumization & Backward Integration to improve margins by 2.7% by FY28E

We believe PAT margin to improve by 3.8% by FY28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

Ltd.jpg)