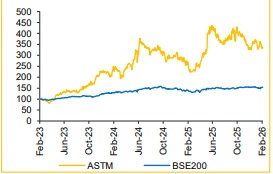

Add Astra Microwave Ltd for the Target Rs.1,030 by Choice Institutional Equity

Tech Depth Intact; Order Visibility Strengthens

We maintain a constructive stance on ASTM as the management commentary reflects steady execution despite a relatively measured quarter. The management tone was confident yet conservative; no aggressive forward promises, but clear emphasis on pipeline strength, technology depth and improving system-level participation

The company continues to operate with a healthy order book of ~INR 25 Bn (2.4x of FY25 revenue). More importantly, the management highlighted a strong bid pipeline across radar subsystems, EW system, missile electronics and space payloads. We believe incremental inflows are likely as key programs transition, from development to serial production.

We believe Radar and EW system remain ASTM’s primary structural growth engines. Deeper system-level integration across indigenous radar, EW and missile programmes are driving higher value capture and margin resilience in the medium term. Steady production traction in key platforms further strengthens revenue visibility. Beyond defence electronics, emerging opportunities in space and secure defence communications add incremental optionality

Steady Quarter but below Expectation

? Revenue for Q3FY26 up by 0.7% YoY and up by 21.3% QoQ at INR 2,602 Mn (vs CIE Est. INR 2,822 Mn).

? EBIDTA for Q3FY26 up by 8.3% YoY and up by 72.5% QoQ at INR 825 Mn (vs CIE Est. INR 790 Mn). EBITDA margin stood at 31.7%, which improved by 224 bps YoY (vs CIE Est. of 28.0%)

? PAT for Q3FY26 down by 1.3% YoY and up by 95.8% QoQ at INR 468 Mn (vs CIE Est. INR 500 Mn). PAT margin contracted by 35 bps YoY, reaching 18.0% (vs CIE Est. 17.7%)

View & Valuation: We maintain our ADD rating with a revised target price of INR 1,030, valuing the stock at 35x of FY28E EPS (earlier 40x). The reduction in target multiple reflects a moderation in topline growth expectations and a recalibration of our forward revenue assumptions.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)