Buy Latent View Analytics Ltd for the Target Rs. 570 By Prabhudas Liladhar Capital Ltd

.jpg)

Unlocking smarter, informed business decisions…

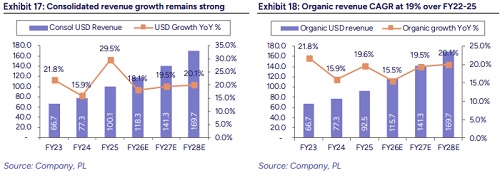

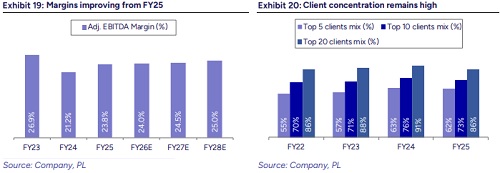

We initiate coverage on Latent View Analytics (LATENTVI) with ‘BUY’ rating and TP of Rs 570 valuing at 40x (Sep’27E earnings), with potential upside of 40%. LATENTVI is a pure-play data analytics and AI (DAAI) service provider, operating in technology, financial services, consumer/retail and industrial domains. LATENTVI’s participation in multi-functional areas and KPI analysis, makes it unique among IT outsourcing providers. It generates ~50% revenue from customer profiling, marketing analytics and promotional activities. Access to a strong data foundation through Databricks partnership, has enabled it to extend enterprise service offerings around GenAI/agentic AI. Revenue from the partnership is expected to see exponential growth of 70%+ CAGR over FY25-28E, while the GenAI/agentic AI pipeline (USD8mn+) indicates constructive uptick in value proposition. LATENTVI’s next leg of growth would come from top 25 strategic accounts (Fortune 500) that are focused on building deep CXO connects across functions. Operating margin is likely to be stable at 23-25%; anything above would be re-invested to drive growth and build tech stack. We estimate USD revenue/INR EBITDA/INR PAT CAGR at 19.2%/25.1%/19.4% over FY25E-28E. Valuation remains inexpensive (~33x FY27E). We assign 40x for earnings CAGR of 19.4% over FY25-28E. Initiate with ‘BUY’.

* Scaling smaller ticket accounts: At least 24 out of 100 active accounts have been serviced for more than 5 years. Accounts scaling effort is visible within the USD1–6mn client bucket: number of clients grew 22.4% CAGR over FY22- 25. But revenue from the bucket is yet to be scaled – grew only ~13% CAGR.

* Monetizing Databricks’ capability: With access to a strong data foundation (Databricks), LATENTVI is expanding enterprise offerings around analytics frameworks along with horizontal capabilities around diagnostics and predictive analytics. Databricks’ engagements majorly involve complex computations and experimentation of POCs and use cases, which account for ~80% of work deliveries. LATENTVI generates low-double-digit revenue through these engagements. The management targets to derive substantial portion, ~25%, of revenue by FY28 through Databricks partnership, vs. ~10- 12% currently (our assumption).

* Value unlocking through strategic investments: Revenue contribution from consumer/retail (consol) has increased to ~15% post integration of Decision Point (DP), from ~9% in FY24. The management plans to increase the share to ~20% over the next 3 years. We believe LATENTVI’s core functional capability (marketing & promotions) is directly complementing DP’s consumer-oriented vertical, which will unlock value for retail enterprise clients.

* GenAI & agentic AI – Key growth drivers: LATENTVI generates high-singledigit revenue through GenAI deployment. Despite the deflationary impact, the management claims to maintain similar budget ownership with higher SOWs across enterprise functions. The management aspires to double the revenue generated through GenAI and agentic AI capabilities in the medium-term. We expect early engagements around agentic AI to mature and soon find their way through multiple business functions, aided by mandates for building a data foundation and pivoting to outcome-based solutions for enterprises.

Story in Charts

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271