Reduce Gujarat Fluorochemicals Ltd For Target Rs. 3,650 By JM Financial Services Ltd

A lot riding on the ramp-up of battery chemicals

GFL’s operational performance in 2QFY26 was largely in line with our expectations while it was slightly better than consensus as it was able to offset the dip in fluoropolymers sales (owing to US tariffs) with high-margin products. With tariffs in place halfway through 3QFY26, 25% sales growth in the fluoropolymers segment seems unlikely. Moreover, amidst uncertainty, approvals for battery chemicals could take longer. As a result, commercial sales could get pushed, in our view. These delays could be key downside risks to our estimates, especially in FY28 where we are pegging in ~40% of incremental EBITDA of FY26E-28E. The rest 60% growth is pencilled in from R-32 and fluoropolymers. Owing to the ramp-up risk of battery chemicals, we maintain our REDUCE rating on the name with a revised SoTP-based Dec’26 TP of INR 3,650 (from Sep’26 TP of INR 3,780 earlier).

* EBITDA largely in line with JMFe: Gujarat Fluorochemicals' 2QFY26 consolidated gross profit came 3% below JMFe at INR 8.6bn (up 3%/6% QoQ/YoY) as revenue came in 9% below JMFe and consensus at INR 12.1bn (down 6% QoQ while up 2% YoY) while gross margin was higher than anticipated at 71% (vs. JMFe of 67% and 65% in 1QFY26). During the quarter, other expenses were lower at ~INR 3.7bn (vs. JMFe of INR 4.1bn). As a result, EBITDA came in 1% below JMFe while 3% above consensus at INR 3.6bn (up 6%/23% QoQ/YoY). Further, PAT was 13%/4% below JMFe/consensus at INR 1.8bn (down 3% QoQ and up 48% YoY).

* Sales miss mainly driven by lower-than-expected fluoropolymer sales: In 2QFY26, fluoropolymers segment sales came ~7% below JMFe and stood at ~INR 7.6bn (vs. JMFe of ~INR 8.2bn, down 4% QoQ while up 8% YoY). The sequential decline in the segment was on account of US tariffs. However, the company has indicated that new fluoropolymer volume has been steadily increasing, and it has started supplying high-purity grades for semiconductor, aerospace and automobile segments. Fluorochemicals sales came in ~19% below JMFe and stood at ~INR 2.6bn (vs. JMFe ~INR 3.2bn, down 15% QoQ/YoY). The decline was mainly due to lower R-22 sales due to quota reduction and seasonality. Also, R-125 sales was affected due to change in demand and US tariffs. Further, bulk chemicals sales stood at ~INR 1.6bn (vs. JMFe of ~INR 1.5bn, up 7%/3% QoQ/YoY). This was driven by higher volume and realisations for chloromethane. Other segment sales stood at INR 300mn (vs. JMFe of INR 330mn).

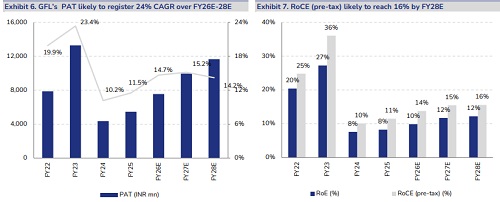

* Estimate 24% EPS CAGR over FY26E-28E; maintain REDUCE: Factoring in challenges in fluoropolymers, and a likely delay in the scale-up of battery chemicals, we cut our FY26-28 EBITDA estimates by ~2-6% and FY27-28 EPS estimates by ~2%. Over FY26E-28E, we estimate GFL to register 26% sales CAGR factoring in i) 17%/21% sales CAGR from fluorochemicals/fluoropolymers segments and ii) INR 12bn revenue from the battery chemicals business in FY28. Further, building in margin compression from the low-margin battery chemicals segment, we estimate ~24% EBITDA/EPS CAGR over the same period. There remains a downside risk to our estimates primarily from potential delay in EV battery chemicals ramp-up. We roll forward to Dec’27E earnings and maintain our REDUCE rating on the name with a revised SOTP-based Dep'26 TP of INR 3,650/share (from Sep’26 TP of INR 3,780 earlier). Key upside risk: faster-than-expected R-32 ramp-up with sustained pricing benefit.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361