Reduce Fusion Finance Ltd For Target Rs. 170 By Emkay Global Financial Services Ltd

Turnaround to be prolonged and challenging

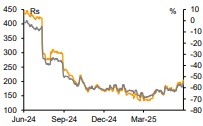

We met with Fusion Finance’s new CEO Sanjay Garyali (ex LTFH, Kotak), to understand his business turnaround plan. He indicated that immediate focus is on managing asset quality and restoring profitability, while adopting a disciplined and diversified portfolio growth approach in the long run. However, we believe the geographic/product diversification away from MFI would lead to elevated operational cost in the initial phase and hurt margins; this would in turn moderate the RoA/RoE trajectory (to 0.9-2.5%/4-10% over FY26-28E from the highs of ~5%/20-21% in FY23-24). Considering the easing going concern issues following the capital infusion (of Rs8bn) by pedigreed investors and the reducing incremental MFI stress flow, we haul up our TP by ~26% to Rs170 from Rs135, valuing Fusion at 1x FY27E ABV; we though retain REDUCE.

Focus on geographic/portfolio diversification to reduce portfolio cyclicality

The new CEO has an eclectic background, including his long stint at banks (KMB, HDFCB) in liability, at GE Capital in assets (housing, 2Ws, consumer finance), and at LTFH in urban finance. Current MD cum Founder Devesh Sachdev will relinquish his position and eventually assume the role of Non-Executive Chairman to preserve institutional expertise in the company. The new MD assured that though he has not directly run the MFI business, he has been part of many business build-up and transformational journeys; hence his expertise should help turn around Fusion. He indicated that the new stress flow rate is easing, though FY26 could largely be a year of consolidating the MFI portfolio, while the company would consciously focus on reducing its MFI portfolio concentration in the states of Bihar, MP, Gujarat, Rajasthan, Odisha, and Maharashtra over the next two years. With the RBI relaxing the threshold for NBFC-MFIs to hold 75% of the assets in MFI loans to 60%, the process of product diversification (eg MSME, mortgage) would accelerate and thus provide portfolio stability in the long run.

Stress flow easing, though credit cost to remain elevated in the near term

Fusion was early to report stress built up in 1Q due to the impact of the heat wave, followed by imposition of MFIN guardrails, with its GNPA ratio touching a high of 12.6% in 3Q and even leading to change in the management. Fusion logged one of the highest shares of borrowers with +3 lenders @31.5%, which remains elevated at 18% as of Mar25. Thus, the unwinding could impact growth/asset quality in the near-to-medium term. The management claims that the new stress flow into 0+ DPD as well as within the 0-90 DPD pool has eased and should hence lead to lower NPA formation in FY26. However, we expect overall credit cost to remain elevated at ~5%, given higher write-offs. Per its strategy, the company also has plans to onboard a Chief Credit Officer, to improve credit underwriting practices and expand its on-field recovery team for driving up hard bucket recovery. Fusion has 19% of its MFI portfolio in the state of Bihar which we believe should be watched, given the ensuing elections.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354