Buy Tata Consultancy Services Limited For the Target Rs. 4,236 by Choice Broking Ltd

Assessing Q3 Results in Light of Trump Tariffs & Macroeconomic Challenges

TCS performance in-line with Q3 estimates on all fronts.

• Revenue for Q3FY25 was at INR 639.7Bn up 5.6% YoY but down 0.4% QoQ (vs consensus est. at INR 647.4Bn). • EBIT for Q3FY25 was at INR 156.5Bn, up 10.3% YoY and 1.2% QoQ (vs consensus est. at INR 159.8Bn). EBIT margin was up 104bps YoY and up 41bps QoQ to 24.5% (vs consensus est. at 24.7%). • PAT for Q3FY25 was at INR 123.8Bn, up 12.0% YoY and 4.0% QoQ (vs consensus est. at INR 125.3Bn).

Strong deal wins and solid growth across emerging markets: TCS reported strong and broad-based TCV of $10.2Bn, including $5.9Bn from North America and $3.2Bn from BFSI. This strong deal win growth signals future revenue potential. While North America and Europe saw declines, emerging markets such as India, Middle East, and Latin America delivered strong growth, with India showing a remarkable 70.2% YoY growth in CC terms.

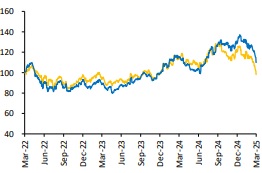

Challenges abound – macro challenges, absence of mega deals and competition from mid-tier peers: TCS faces these challenges, however opportunities are emerging in key areas; driven by rising demand, deal consolidation, digital transformation initiatives. Looking ahead, TCS anticipates stable IT budgets for CY25 and a positive outlook for discretionary spending, particularly in the BFSI vertical. However, Retail and Manufacturing verticals are expected to revive post Q4, while the recovery of Healthcare and Life sciences verticals will depend on policy clarity. The company anticipates a boost in demand driven by factors like reduced interest rates, easing inflation, and political stability in the US.

Potential slowdown in IT spends amid Trump tariffs: While TCS faces some revenue pressure due to rising costs for IT clients in the US, Canada, and Mexico, its diversified global presence and broad service offerings help mitigate these risks. TCS has established footprints in Canada and Mexico, where it provides services to US clients, who may be impacted by potential tariff threats. Considering the same, slowdowns in IT spending or delayed contract renewals from such companies may affect sectors like Manufacturing and Retail, where TCS holds significant exposure. Currency volatility is also a risk that could affect profit margins.

TCS workforce, attrition, and EBIT outlook : As of Q3FY25, TCS workforce stood at 607,354, reflecting a net reduction of 5,370 employees despite signs of recovery driven by productivity and utilization improvements. The company reported LTM attrition rate of 13.0%. TCS is targeting operating margins in the range of 26-28%, with a goal of reaching 26% by Q4. Potential margin enhancements could stem from the decline in the BSNL contract and a more favorable product mix expected in FY26.

View and Valuation: Given the on-going macroeconomic challenges, increased competition from GCCs, mid-tier peers, and the moderation in PAT growth, we have revised PE multiple to 24x based on FY27E EPS of INR176.5. We project Revenue/EBIT/PAT to grow at a CAGR of 10.7%/ 13.7%/ 14.0%, respectively, over FY25E-FY27E. As a result, we maintain our rating to BUY by downgrading our target price to INR4,236.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131