Buy Mahindra Lifespace Developers Ltd For the Target Rs. 637 by Choice Broking Ltd

Degrowth in Presales due to approval delays, launches likely to pick up in Q4FY25.

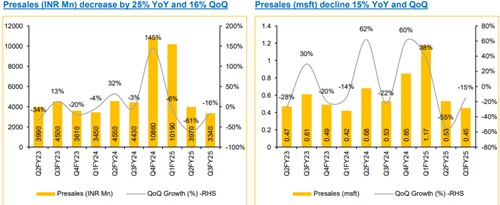

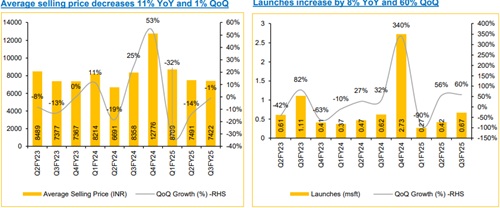

* Q3FY25 Presales at INR 3,340 Mn, down 25% YoY and 16% QoQ (vs CEBPL est. INR 4,907 Mn).

* Collections for Q3FY25 were at INR 3,660 Mn, down 5% YoY and 20% QoQ (vs CEBPL est. INR 4,648 Mn).

* Launches for Q3FY25 stood at 0.67 msft, up 8% YoY and 60% QoQ.

* .Average Selling Price was INR 7,422 per sqft , down 11% YoY and 1% QoQ.

* Q4FY25 to be a launch heavy quarter with launch pipeline of approximately INR 19000 Mn.

Thane and Bhandup projects to be a key turning point :

The Thane and Bhandup project value is to be around INR 70-80 Bn and INR 120 Bn respectively, accounting for approximately 44% of its total GDV (gross development value) of INR 450 Bn. The Thane and Bhandup projects will be a mix of Commercial and Residential projects and will be launched in multiple phases over time..

Plotted development projects would drive healthy operational cashflows:

Post the successful launches of its maiden plot in Chennai, MLIFE is now fast-tracking second plotted project in Chennai, Project Pink in Jaipur followed by multiple launches over 12-18 months As plotted projects are high velocity in nature, and IRR is comparatively better than residential projects, this would help in faster realization of funds and healthier cash flows to meet the long term growth plan of MLDL.

IC&IC segment velocity to remain muted :

During the quarter MLIFE leased 12.4 acres of land to 5 customers for Rs.457mn. Management expects the leasing velocity to improve however it is a lumpy business by nature.. Management is optimistic about demand picking up in the next 2 years. The company's long-term plan remains to monetize the IC&IC business.

Demand for affordable housing in India will be supported by the new tax breaks in the Union Budget along with a rate cut by the RBI which would in turn lead to lower EMIs, making borrowing easier for homebuyers. This bodes well for MLIFE due to its established brand image in the affordable, mid-premium and premium segment.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131