Buy Apollo Hospitals Enterprise Ltd For Target Rs. 8,000 By Choice Broking Ltd

Business Overview: APHS is one of the largest healthcare conglomerates in India, founded by Dr. Prathap C. Reddy in 1983. The company operates a chain of multi-specialty hospitals, diagnostic clinics, pharmacies, and provides telemedicine services. It has a significant footprint in India and a growing presence internationally. APHS runs over 70 hospitals across India, with a total bed capacity exceeding 10,000. It focuses on specialized services such as oncology, cardiology, and orthopedics. It also operates one of India’s largest pharmaceutical retail chains and has a strong diagnostic and telemedicine business, offering services through Apollo Clinics and Apollo 24/7, which extends the hospital's reach beyond physical locations.

Can Apollo Hospital’s Sustain Its Growth Momentum with Metro-Focused Expansion?

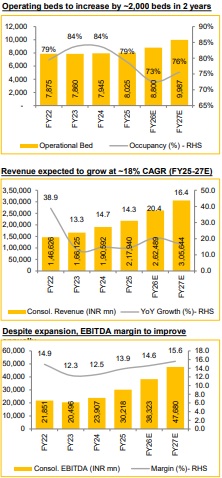

APHS is executing a strategic capacity expansion plan aimed at adding 1,937 beds in FY26, representing a ~20% increase over its current capacity. This growth targets high-demand urban markets such as Pune, Kolkata, Delhi, Hyderabad, and Gurugram. Kolkata (270 beds) and Delhi (510 beds) hospitals are expected to achieve EBITDA breakeven within 12 months, leveraging APHS brand strength and market presence. Over the next 3–4 years, APHS plans to add a total of 4,372 beds, with a strong focus on high-margin specialties like oncology, neurosciences, and cardiac sciences. This expansion is aligned with projected inpatient volume growth of 6–7% annually, fueling ARPOB and sustaining robust EBITDA margins at 24%.The metro-focused growth strategy positions APHS to deepen its presence in markets while maintaining operational efficiency and margin strength.

Can Apollo’s Diagnostics and Pharmacy Businesses Deliver Scalable and Profitable Growth?

APHS is strategically scaling its Diagnostics and Pharmacy divisions by combining digital leverage, market expansion, and strategic partnerships to drive both growth and profitability. Diagnostics is targeting a 15–18% revenue CAGR, with an EBITDA margin improvement of 200bps to ~10% by FY27. Pharmacy is expected to grow at a robust 20% annually, with a path to achieving 5–6% EBITDA margins by FY27. Strategic tie-ups with insurers are enhancing operating leverage and profitability, particularly through integrated care models. Expansion plans include growing from 6 core markets (which generate 80% of revenue) to 25 high-potential cities over the next 2 years, supported by APHS digital health ecosystem & supply chain efficiency

Why Invest in APHS?

APHS is India’s leading integrated healthcare provider, offering strong long-term growth driven by its diversified business model across hospitals, diagnostics, pharmacy, and digital health. With a metro-focused capacity expansion adding ~20% beds by FY26 and a pipeline of 4,372 beds over 3–4 years, APHS is positioned to capture rising healthcare demand in high-margin specialties like oncology and cardiac sciences. Its diagnostics and pharmacy businesses are scaling rapidly, targeting doubledigit EBITDA margins supported by digital platforms and insurer partnerships. Strong brand equity, proven execution, and consistent EBITDA margins (~24%) underscore operational excellence. With inpatient volume growth of 6–7% and ARPOB expansion, APHS offers a compelling blend of scale, profitability, and structural tailwinds—making it a solid long-term investment.

Recommendation: We currently have a ‘BUY’ rating on the stock with a target price of INR 8,000.

Key Risks:

* Regulatory Risks: Healthcare is a highly regulated sector in India, and changes in government policy can impact business operations.

* Competition: Intense competition from other hospital chains, diagnostic centers, and pharmacy chains can pressure margins.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131