Buy Apollo Hospitals Ltd for the Target Rs. 9,015 by Motilal Oswal Financial Services Ltd

Improved case mix/Healthco drives earnings

Calibrated approach to improve GMV prospects; bed additions on track

* Apollo Hospitals Enterprises (APHS) delivered largely in-line revenue for the quarter. It delivered better-than-expected EBITDA/PAT, led by improved profitability in the hospitals/Healthco business.

* APHS is focused on optimizing the CONGO/payor mix to ensure profitable growth at existing hospitals. Patient volume growth was soft for the quarter due to a higher base of medical admissions in the past year. Notably, CONGO specialties’ revenue grew 14% YoY.

* Further, bed additions are expected to start from 3QFY26 onwards, aimed at supporting expansions into new locations and strengthening the Apollo group’s brand franchise.

* Offline pharmacy’s revenue grew 16% YoY, led by improved same-store sales growth as well as store additions. Platform GMV grew 16% YoY, led by healthy growth in pharma transactions as well as transacting users.

* We raise our FY26 earnings estimate by 5%, factoring in better Healthco performance. However, we reduce our FY27 estimates by 5%, factoring in higher operational costs related to the launch of new hospitals. We value APHS on an SoTP basis (30x EV/EBITDA for the hospital business, 20x EV/EBITDA for retained pharmacy, 25x EV/EBITDA for AHLL, 23x EV/EBITDA for front-end pharmacy, and 2x EV/sales for Apollo 24/7) to arrive at our TP of INR9,015.

* We remain positive on APHS, supported by: a) the optimization of case mix/addition of beds in healthcare services, and b) continued improvements in the pharma/diagnostics/insurance segments for better GMV growth prospects. Reiterate BUY.

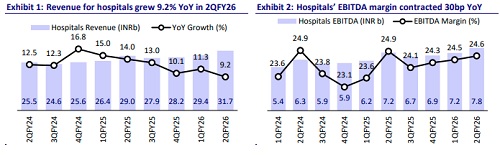

Sustained momentum in revenue growth

* APHS’s 2QFY26 revenue grew 13% YoY to INR63.0b (our est: INR61.4b).

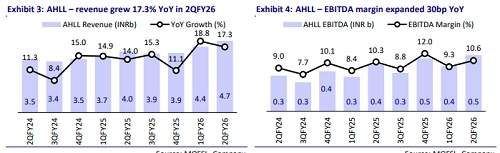

* Healthcare services’ revenue grew 9% YoY to INR31.7b, driven by growth in both inpatient volume (+2%) and the price and case mix (+7%). Healthco’s revenue grew 17% YoY to INR26.6b. AHLL’s revenue grew 17% YoY to INR4.7b, primarily driven by growth in diagnostics.

* EBITDA margin expanded 30bp YoY to 14.9% (our est 14.5%). EBITDA grew 15.4% YoY to INR9.4b (our est: INR8.9b).

* Adj. PAT grew 26% YoY to INR4.8b (our est: INR4.4b).

* Revenue/EBITDA/PAT grew 14%/20%/33% YoY in 1HFY26 to INR121.5/17.9/9.1b.

Highlights from the management commentary

* The hospital business recorded limited IP/OP volume YoY growth due to a high season-related base in 2QFY25. Lower patient flow from Bangladesh further impacted growth on a YoY basis.

* APHS achieved a 14% YoY revenue growth in CONGO specialties, helping offset the high base impact from last year in the hospital business.

* The company has pushed its target of achieving cash break-even in Healthco (excluding ESOP) by a quarter.

* APHS has commenced the commissioning of hospitals at Defence Colony, Delhi, and Royal Mudhol, Pune, in 3QFY26. The Sarjapur and Bengaluru hospitals are expected to be commissioned in 4QFY26, while the Hyderabad and Gurugram hospitals are scheduled for 1QFY27. Overall opex related to these hospitals is expected to be INR1.5b on an annualized basis.

* The company aims for cost savings of INR1.2b, of which INR600m has already been achieved through improved material management and supplier consolidation. Further optimization is expected from HR efficiencies and reduced IT spend.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)