Buy Kaynes Technologies Ltd for the Target Rs. 8,200 by Motilal Oswal Financial Services Ltd

Execution strength drives record growth

Operating performance in line with estimate

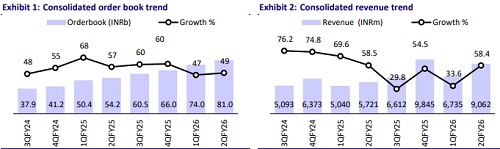

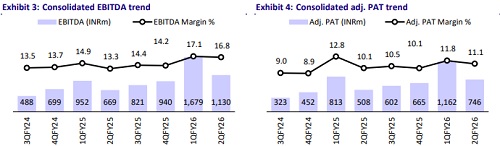

* Kaynes Technologies (KAYNES) continued its strong operating performance in 2QFY26, with revenue growth of 58% YoY, while EBITDA grew at a much faster pace of 80% YoY. This was fueled by a gross/EBITDA margin expansion of 480bp/200bp YoY, driven by higher-margin projects, operational leverage, and product diversification.

* The company maintains its full-year revenue guidance of INR45b, indicating an implied growth of ~64% YoY in 2HFY26. KAYNES also reiterated its EBITDA margin guidance of over 16% for FY26. However, working capital was elevated in 1HFY26, led by higher inventory levels toward the end of the quarter and a rise in trade receivables, reflecting strong growth and back-ended billing. The company is exploring multiple options, such as discounting and vendor inventory management, to reduce working capital.

* We keep our EPS estimates unchanged for FY26/FY27/FY28 and reiterate our BUY rating on the stock with a TP of INR8,200 (premised on 50x Sep’27E EPS).

Favorable business mix supports margin expansion

* Consolidated revenue grew 58% YoY to INR9.1b (est. in line) in 2QFY26, while EBITDA grew 80% YoY to INR1.5b (est. in line). EBITDA margin expanded 190bp YoY to 16.3% (est. in line), led by an expansion in gross margin (up 5pp YoY) due to a favorable business mix and reduction in raw material costs, which were partly offset by higher employee costs (up 150bp YoY) and other expenses (up 130bp). Adj. PAT grew 2x YoY to INR1.2b (est. INR1.1b).

* Order inflows remained strong at INR16b in 2Q, boosting the order book by 49% YoY/9% QoQ to ~INR81b, anchored by Industrials and Automotive.

* For 1HFY26, Revenue/EBITDA/adj. PAT grew 47%/75%/77% to INR15.8b/INR2.6b/INR1.9b. For 2HFY26, the implied revenue/EBITDA/PAT growth is ~64%/72%/98%.

* For 1HFY26, net working capital days increased to 116 from 108 days in 1HFY25. Receivable days rose 56 days YoY, which are expected to normalize going forward. Net debt stood at ~INR4.2b vs. INR4.9b as of Sept’24.

* Gross debt stood at INR8.5b as of Sep’25, as against INR8.8b as of Mar’25. Further, the company had a cash outflow of INR2.2b as of Sept’25, as against a cash outflow of INR823m as of Sept’24. The company expects to generate significant CFO by the end of FY26 through the optimization of working capital days.

Highlights from the management commentary

* Guidance: Management retained its full-year revenue guidance of INR4.5b (with INR42.5b from the EMS business, INR1b from the OSAT business, and INR1.8b from the Canadian business).

* OSAT business: At the Sanand OSAT Facility, the company reached an important milestone by successfully delivering India's first commercially manufactured multi-chip module in collaboration with Alpha and Omega, L&T Semiconductor, and Mitsu & Company. Further, the company has made a strategic collaboration with Infineon, marking its entry into EMS-based true wireless stereo packaging. 60% of OSAT capacity is already committed to anchor customers mentioned above.

* PCB: The first phase at Oragadam, Chennai, is on track for commissioning by the end of FY26, with shipments expected from Apr’26. The facility will produce high-density interconnect (HDI), multi-layer (up to 76 layers), and flex PCBs, with interest already received from ~16 global and domestic customers. KAYNES has also received government approval and capital subsidy under the PLI scheme for the second phase (capex of INR37b) of its advanced PCB manufacturing project near Tuticorin. This will enhance capacity and product scope over the next three years, completing KAYNES’ backward integration across laminates, prepregs, and PCBs.

Valuation and view

* KAYNES continued its strong operating performance in 2QFY26 with an all-round performance. With a robust order book as of Sep’25 (INR81b), the company is likely to sustain strong revenue growth momentum going forward.

* With recent approvals under the electronic component manufacturing scheme (ECMS) for HDI, multi-layer PCB, camera module assembly, and laminates, the company reaffirms its commitment to expanding its scope of work in highmargin, high-growth verticals, aligned with the GOI’s ambition of Atmanirbhar Bharat.

* We estimate a revenue/EBITDA/adj. PAT CAGR of 52%/60%/64% over FY25- FY28. Reiterate BUY with a TP of INR8,200 (premised on 50x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)