Accumulate Oil India Ltd for the Target Rs.527 by PL Capital

Quick Pointers:

* Oil realization at USD62.8/bbl, while gas realization at USD6.7/mmbtu

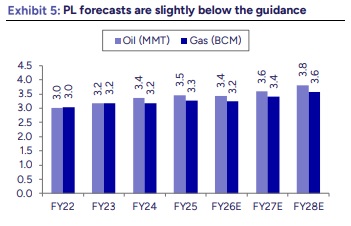

* Crude oil production is guided at 3.8mmt in FY27 and 4.0mmt in FY28

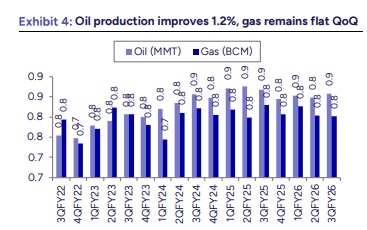

We revise our rating to ’Accumulate’ led by expected delay in achieving the production guidance of 4mmt for oil and 5bcm for gas. In Q3FY26, crude oil production grew 1.2% QoQ to 0.9mmt, while gas production remained flat QoQ at 0.8bcm. Oil price realization fell QoQ to USD62.8/bbl vs. USD68.2/bbl. Other expenses increased to Rs19bn from Rs12.9bn YoY led by Rs5bn of one-off items. Consequently, EBITDA declined to Rs13.1bn (-38.7% YoY, -1.2% QoQ; PLe: Rs15.9bn; BBGe: Rs17.0bn), while PAT came in at Rs8.1bn (-33.8% YoY, -22.6% QoQ; PLe: Rs10.2bn; BBGe: Rs9.0bn). The company expects to drill ~75 wells in FY26 and ~100 wells in FY27. The management expects FY26 production to surpass FY25 levels. For FY27/28, the management has guided oil production at 3.8mmt/4.0mmt; however, we remain conservative. We build in oil/gas volume of 3.6mmt/3.4bcm in FY27E and 3.8mmt/3.6bcm in FY28E. Valuing the standalone business at 11x Dec’27E adj EPS and adding the value of investment in NRL, we arrive at TP of Rs527 (earlier: Rs538) and revise the rating to ‘Accumulate’ from ‘BUY’.

Q3FY26 volume: Oil production rose marginally by 1.2% QoQ, but declined by 1.2% YoY to 0.9mmt in Q3FY26, while gas production stood at 0.8bcm (flat QoQ, -3.4% YoY). Consequently, total volume was flat QoQ and declined 2.2% YoY to 1.7mmt. The company plans to drill ~75 wells in FY26 and ~100 wells in FY27. Total production is guided at ~7.5mmtoe in FY27 and 8.0–8.5mmtoe in FY28. FY26 total production is now expected to be in line with FY25, while FY27 and FY28 crude oil guidance is reiterated at 3.8mmt and 4.0mmt, respectively.

NRL: NRL reported throughput of 752.4tmt in Q3FY26, flat QoQ, but lower than 808.5tmt in Q3FY25. GRM improved sharply to USD16.3/bbl (vs. USD10.6/bbl in Q2FY26 and USD2.1/bbl in Q3FY25). Consequently, EBITDA increased to Rs13.0bn, up from Rs9.9bn in Q2FY26 and Rs6.7bn in Q3FY25.

NRL capacity expansion: CDU and VDU units have been commissioned in Dec’25 and stabilization is expected by end of Q4FY26. OINL does not expect any major throughput in FY26 from the expanded capacity. Post full commissioning, refinery utilization is guided to reach 50–60% in Q4FY27, ~75% in Q1FY28 and 100% from Q2FY28. Accordingly, meaningful refining margin contribution is expected from Q2FY28. The petchem complex is slated for commissioning in the latter part of FY28, with FY29 being the first full year of combined refinery and petchem operations.

One-off items including write offs: OINL recognized a write-off of Rs0.9bn in Q3FY26 related to the Assam–Arakan well. Additionally, provisions during the quarter included Rs2.2bn for the Andaman well, Rs0.9bn for the Mahakali well, and Rs0.8bn for the Zokai well.

9MFY26 profitability: On a 9MFY26 basis, oil production fell 2.1% YoY, while gas volume remained flat, leading to a total volume drop of 1.3% YoY to 5.0mmt. Oil realization fell to USD65.7/bbl (vs. USD 74.1/bbl YoY), and gas realization was largely stable at USD6.7/mmbtu (vs. USD6.7/mmbtu). Lower realization, along with higher write-offs and provisions, led to revenue declining 7.3% YoY to Rs153.9bn and EBITDA falling 37.5% YoY to Rs42.4bn. Adjusted PAT declined 41.1% YoY to Rs26.7bn.

Above views are of the author and not of the website kindly read disclaimer