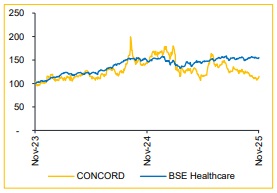

Add Concord Biotech Ltd For Target Rs. 1,615 By Choice Broking Ltd

Growth Outlook Moderates despite Long-term Visibility

We believe that, while CONCORD will continue to grow, the pace is likely to moderate, given the slower momentum observed in H1. Although management expects a pickup in H2, we think the company will still fall short of its earlier targeted 25% revenue CAGR over the next three years. We now forecast a more conservative 17% CAGR. EBITDA margin is expected to contract slightly in FY26E due to facility ramp-up cost, before normalising back to FY25 levels by FY27 as utilisation improves. Given the tempered growth outlook, we revise our estimate downward by 3.9%/4.0% for FY26E/27E. We also lower our valuation multiple to 30x (from 35x) and arrive at a revised TP of INR 1,615 (vs. INR 1,965 earlier). Hence, we downgrade the rating to ADD.

Strong Sequential Recovery despite YoY Drag

* Revenue de-grew 20.4% YoY but increased 21.1% QoQ to INR 2,471 Mn (vs. CIE estimate: INR 3,102 Mn).

* EBITDA de-grew 35.3% YoY but increased 44.1% QoQ to INR 885 Mn (vs. CIE estimate: INR 937 Mn); margin contracted 825 bps YoY but expanded 572 bps QoQ to 35.8% (vs. CIE estimate: 30.2%).

* PAT de-grew 34.1% YoY but increased 43.1% QoQ to INR 631 Mn (vs. CIE estimate: INR 834 Mn).

API Segment faces Near-term Growth Softening

API revenue declined 16.6% YoY, impacted by order delays stemming from tariffrelated uncertainties, pending CDSCO renewals and the deferment of a large government contract in the Middle East due to geopolitical issues. While these orders are expected to recover in H2, the weak H1 performance is likely to weigh on the full-year trajectory. We now expect the API segment to grow in the low teens for FY26.

Formulations Recovery hinges on Ramp-Up

Formulations witnessed a sharp 31.0% YoY decline, largely driven by timingrelated delays, including the same tender deferment in the Middle East and the lack of contribution from the newly-commissioned injectables facility (March). Given this slower start, achieving the earlier target of 35–40% growth over the next three years appears challenging. For FY26, we now expect growth to settle in the high-teens range, with some upside contingent on the pace of injectables’ ramp-up and timely order execution.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131