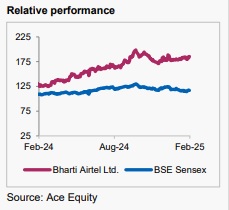

Buy Bharti Airtel Ltd For the Target Rs. 1,900 By The Axis Securites

Recommendation Rationale

The company's digital portfolio is gaining momentum along with market share gains • The company maintained a substantial share of 4G/5G net ads in the market, with the 4G customer base expanding by 6.5 Mn QoQ and 25.2 Mn YoY. This now constitutes 77.8% of the overall customer base. • The company’s ARPU continues to be the best in the industry, and average data usage per customer stands healthy at 24.5 GB/month. • The management remains optimistic about sustaining long-term demand growth, driven by a robust digital services portfolio, increasing rural adoption of 4G, and improved cash flow management.

Sector Outlook: Positive

Company Outlook & Guidance: The company expects consistent revenue growth across its core business segments, driven by increasing 4G and 5G adoption, broadband expansion, and enterprise solutions. EBITDA margins are projected to remain strong, supported by operational efficiencies, network optimisation, and digital service monetisation. Management remains committed to financial prudence, ensuring sustainable free cash flow generation and debt reduction. Capex levels are expected to moderate in FY26, reflecting a decrease in 5G radio investments. It has already prepaid a significant portion of spectrum debt and expects a gradual reduction in the Capex-to-revenue ratio, aligning with global telecom peers. Airtel emphasises the need for continued tariff rationalisation to improve the industry's financial health.

Current Valuation: SOTP based

Current TP: 1,900/share (Earlier TP: Rs 1,880/share)

Recommendation: Given the company’s strong recovery potential backed by strong conversion, rising digital portfolio, and moderated Capex, we maintain our BUY recommendation on the stock.

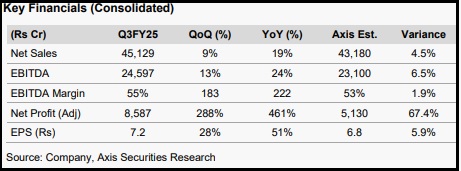

Financial Performance In Q3FY25, Bharti Airtel Ltd. (Bharti) reported revenue of Rs 45,129 Cr, up 9% QoQ and 19% YoY, exceeding our expectations. This growth was driven by strong momentum in India and continued underlying growth in constant African currency. India revenues for Q3FY25 stood at Rs 34,654 Cr, reflecting a 24.6% YoY and 9.8% QoQ increase. Mobile revenues grew 21.4% YoY, primarily driven by the residual impact of the tariff hike. ARPU for the quarter stood at Rs 245, compared to Rs 208 in Q3FY24, and was also higher than its peer, Jio, which reported Rs 203 in Q3FY25.

Financial Performance (Cont’d) The company has 120 Mn 5G customers, with 5G handsets making up over 80% of smartphone shipments. Further 5G expansion is planned. Airtel added 6.74 Lc broadband customers and expanded Fixed Wireless Access (FWA) coverage to over 2,000 cities. Fiber home pass additions stood at 1.9 Mn per quarter. Bharti Airtel plans to transfer 16,100 telecom towers to Indus Towers to improve operational efficiency and free up management bandwidth. The company posted a healthy operating profit of Rs 24,597 Cr, benefiting from higher 4G conversions and an improved service mix—operating margins expanded by 183bps to 55%, supported by the strong premiumisation of accounts. The net profit for Q3FY25 stood at Rs 16,133 Cr, which included an exceptional gain of Rs 7,546 Cr. Adjusted PAT (excluding exceptional gains) came in at Rs 8,587 Cr, registering an increase of 107% QoQ.

Outlook From a long-term perspective, Bharti Airtel remains well-positioned for sustainable growth, backed by its strong digital services portfolio, disciplined capital management, and focus on high-value customer segments. The company expects gradual ARPU improvement, 4G/5G expansion, and B2B growth to drive long-term profitability. We remain optimistic about the company’s future growth.

Valuation & Recommendation We maintain our BUY rating on the stock, given the company's superior margins, stronger subscriber growth, and higher 4G/5G conversions. Based on the SOTP valuation, We value the stock with a target price of Rs 1,900, indicating a potential upside of 14% from the current market price (CMP).

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633