Buy PVR INOX Ltd For Target Rs. 1,610 By JM Financial Services

Karnataka price-cap: a non-issue

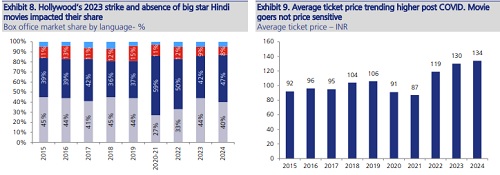

Karnataka state government has proposed an INR 200 price-cap for movie tickets. This is not the first time. Previous attempt (2017) offers two precedents. One, special format screens – where PVR-Inox’s tickets are dearer – were exempt. Two, it could face legal hurdles. Prior court rulings - High Courts as well as Supreme Court – have struck down price regulation orders. Even if enforced, the impact will be miniscule. We estimate an impact of c.INR 190mn or c.0.3% of FY26E revenues (Exhibit 2). Box office collection in Q4 (INR 20bn in Jan/Feb), on the other hand, is looking up. That, along with a healthy pipeline, far outweighs price-cap fears. As we noted in Wrong Causality, recent correction was likely technical, which is behind. In fact, tailwinds are now emerging. Return of big banner movies, better pipeline of Hollywood/Bollywood movies (where PVR-Inox has higher share) along with higher disposable income (due to income tax relief) should support occupancies. Reasonable valuations – c.9x EV/EBITDA (pre IND AS) – limit downside. These are strong arguments to BUY.

* Karnataka’s price-cap proposal: Karnataka state government, in its 2025-26 budget, has proposed a state-wide cap of INR 200 on movie ticket prices across cinemas. A similar cap was proposed in 2017. Previous attempt by the government to cap prices offers two precedents: a) price-cap was applicable only to mainstream screens. Gold class seats (up to 10% of mainstream screens’ seats) and special format screens – IMAX and 4Dx – were expemted. Note, PVR-INOX’s dearer tickets are for these special formats. And b) the ruling faced legal hurdles and never got officially implemented. Besides Karnataka, there are precedences - Andhra Pradesh High Court (Aug 2022) and Supreme Court (Chandrachud and Narsimha bench, Jan 2023) – where courts struck down attempt to regulate movie ticket prices. It is therefore not a given that such caps will see light of the day. Unsurprisingly, multiplex operators have indicated that they would wait for an official govt. order detailing the cap, before making any price adjustments.

* Negligible impact on PVR INOX: In a scenario where the proposed price-cap does get enforced, the impact on PVR-Inox will be miniscule, per our estimate. PVR-Inox has 215 or 12% of its screens in Karnataka. However, c.20% of these screens, we believe, are special format ones. These, going by 2017 precedence, will be likely exempted. Assuming ATP (INR 252 gross ATP) and occupancy levels (c.24%) for the balance screens to be same as company average, the full year revenue impact of price-cap would be INR 192mn or 0.28% of revenues (Exhibit 2). The impact on EBITDA will be even lower. Clearly, there are bigger headwinds for PVR-Inox to stress about.

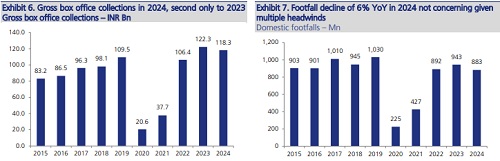

* Encouraging GBOC, promising pipeline far outweighs price-cap’s impact: Content, pipeline and occupancies (or lack of these) have weighed on the stock more. These are however on the mend now. India’s GBOC for Jan and Feb 2025 was INR 20.4bn. In addition, strong line-up for March (e.g Sikandar) and ~INR 1.8bn BOC for Chhaava and Dragon in March, we believe Q4FY25 BOC could get closer to Q3FY25’s record GBOC of INR 39.8bn. Moreover, content line-up for rest of CY25 is promising too (Exhibit 12). At 9x FY26E EV/EBITDA (pre-Ind AS), we find current levels attractive. BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361