Buy Stove Kraft Ltd For Target Rs. 1,029 By Yes Securities Ltd

Exports to be growth driver; re-iterate BUY

Result Synopsis

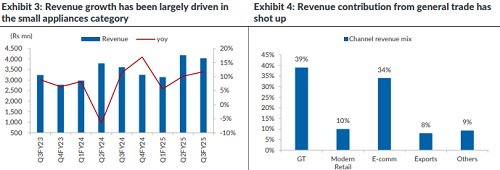

STOVEKRAFT has delivered marginally lower than expected revenue growth with revenue growing 11.7% yoy (1.8% below estimates). Decline in induction cooktop (-10.7%) and Nonstick cookware (-3.0%) have resulted in below than expected revenue growth, while appliances continue to see strong growth of 28.6%. Management maintains is reiterating its stance of faster than industry growth and is confident of achieving more than 10% growth. Gross margin has contracted by 95bps yoy to 37.6%, higher discounts and offers post the festive season has resulted in lower gross margins. EBITDA margin at 10% has lower as there have been higher marketing and maintenance expenses incurred during the quarter. The company is aiming to reach EBITDA margin of 14% in next 3-5 years in the interim the company will operate in EBITDA range of 11-14%. STOVEKRA is working towards bringing down receivable days and inventory days thereby able to bring down borrowings considerably. With current capacities the company can double its revenue from current levels. Exports is expected to drive the revenue for company going forward. The company has formed strategic partnership with IKEA where company will develop and supply cookware globally from FY26. The company is anticipating Rs1500mn of revenue from the IKEA partnership most of which will be accruing in FY27. Moreover, the company is setting up bakeware line for Walmart which is premium product and with this company expects its exports contribution to increase to 25% from current 12%. We remain optimistic of the company’s performance given the exports is shaping up and which can be ramped up further. On the domestic front the company is optimistic of growing faster than the industry

Considering better than expected industry growth and continued strong growth potential and now with sustainable double digit margins potential we remain positive on the stock. We estimate STOKRA to deliver revenue CAGR of over FY24-27E of 12% which looks achievable given the export potential and domestic growth. We estimate EBITDA margin of 11% in FY26 in line with the management’s guidance. Management has started to deliver on both revenue and improvement in margin. We remain positive on the stock and continue to value the stock at 35x on FY27 EPS with PT of Rs1,029 and reiterate BUY rating

Result Highlights

* Quarter summary –Company delivered revenue growth of 11.7% missing estimates by 1.8%. Miss was on account of revenue decline in Induction cook-top and nonstick cookware.

* Ikea- Company’s has inked a strategic partnership with IKEA to develop and supply cookware globally from FY26. IKEA partnership provides revenue potential of Rs1500mn, for which supply is expected to start October 2025.

* Exports – Exports contribution is expected to increase from current 12% to 25% in next 3 years. Apart from Walmart and Ikea the company is in talks with other players as well for export opportunities.

* Distribution expansion – During the quarter 17 exclusive pigeon retail stores were added (15 of them are on COCO model and 2 of them are on FOFO model) The company currently has 230 stores and plan to add 25-30 stores each quarter.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632