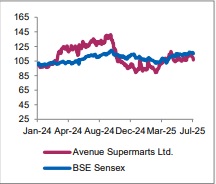

Buy Avenue Supermarts Ltd for the Target Rs. 4,810 - Axis Securities Ltd

Margins Fell Short; But A Recovery is Anticipated in H2

Est. Vs. Actual for Q1FY26: Revenue – INLINE; EBITDA – MISS; PAT – MISS

Recommendation Rationale

• In Q1FY26, DMart reported a 16.3% YoY revenue growth, partially impacted by a 100–150 bps drag from deflation in key staples and non-food categories, as well as the temporary closure of a Navi Mumbai store for renovation. The company added 9 new stores during the quarter, taking the total store count to 424. Like-for-like growth stood at 7.1%, with the total retail area reaching 17.6 Mn sq. ft. by the end of the quarter.

• EBITDA grew by 6.4% YoY; however, margins contracted by 74 bps YoY to 7.9% due to gross margin pressure arising from increased competitive intensity in FMCG. Additionally, higher manpower costs at the entry level—driven by rising opportunities in the gig economy—along with continued store expansion, impacted EBITDA margins.

• Despite facing headwinds from a muted demand environment in recent years, DMart’s strategic focus on enhancing store productivity, improving profitability, and reviving the General Merchandise & Apparel (GM&A) segment indicates a clear course correction. With consumer demand improving, macroeconomic conditions stabilising, and a robust festive season anticipated in H2FY26, these initiatives are well-aligned to support recovery and drive growth in the high-margin GM&A categories. Key risks include a prolonged recovery in consumer demand and heightened competitive intensity.

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: Considering the company’s recent initiatives, coupled with store expansion and an improved demand environment, we maintain our BUY rating on the stock.

Current Valuation: 73x Mar-27 EPS (Earlier-71x Mar-27 EPS ))

Current TP: Rs 4,810/share (Earlier – Rs 5091/share)

Recommendation: With an 18% upside from the CMP, we maintain a BUY rating on the stock.

Financial Performance: In Q1FY26, DMART’s consolidated revenue grew by 16.3% YoY to Rs 16,360 Cr. EBITDA grew by 6.4% YoY, whereas EBITDA margins declined by 74bps YoY to 7.9%. This was on account of higher Opex and gross margin contraction. The company reported a PAT of Rs 773 Cr, down by 0.1% YoY

Outlook: D-Mart has faced several challenges over the past few years, primarily due to a subdued demand environment, particularly in the value segment. Larger and newer stores have longer gestation periods, which have impacted overall profitability, alongside increasing competition from both organised players and online platforms. However, the company has taken several initiatives to address these headwinds, including: 1) changes in leadership aimed at revamping the slowing GM&A category, 2) a focused approach to improving profitability in D-Mart Ready through a calibrated expansion strategy, and 3) a targeted 15% store addition on the existing base of 424 stores, which is seen as a prudent growth step. Additionally, improving consumer demand, aided by stable macroeconomic conditions and a robust festive outlook in H2FY26, is expected to bolster these efforts and drive growth in high-margin general merchandise and apparel categories.

Valuation & Recommendation: We estimated CAGR 19%/19%/19% for Revenue/ EBITDA/ PAT over FY24-27 on account of improving overall outlook. Hence, we maintain our BUY rating on the stock with the revised TP to Rs 4,810/share. The TP implies an 18% upside from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633