Add Aditya Vision Ltd For Target Rs.450 By Emkay Global Financial Services Ltd

Bloated WC drives rating downgrade; topline trends healthy

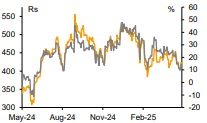

We downgrade AVL to ADD from Buy, while pulling down our TP by ~20% to Rs450 (from Rs565), following a ~10% cut each in our estimates/TP multiple. While we continue to like AVL’s growth potential and strengths in the Hindi Heartland, the cautionary downgrade is led by potential margin risks on an inflated balance sheet at FY25-end. Though AVL attributed a ~60% increase in inventory to pre-season stocking and compressor supply disruptions, we are concerned about stock liquidation risks through FY26, in light of the unseasonal rains and single-digit growth trends in Q1FY26TD. With continued growth investments in new areas of operations (UP), EBITDA margin was down by 60bps to 9% in FY25 and a 60-80bps miss was seen in Q4 (8.7%; down by 130bps), albeit revenue growth trends remain healthy at ~30% in Q4/FY25 (19%/15% SSG in Q4/FY25). Expansion in UP is progressing well, with AVL seeing a ~200 store opportunity in UP (vs 34 stores currently). AVL added 30 stores in FY25 and targets adding 25-30 stores in FY26, with an upside risk.

In-line and strong topline; higher growth investments drive 7-8% EBITDA miss

Of the reported 30% revenue growth in Q4, SSG entailed 19%, with the balance contributed by new stores. SSG performance for FY25 stands at 15%; AVL expects the double-digit SSG to sustain going forward. While Apr-25 trends are muted, AVL expects a recovery in May-Jun, as the summer season unfolds and given its growing presence in the Hindi Heartland, which typically sees a longer and harsher summer season. AVL added 14/30 stores in Q4/FY25, taking the total store-count to 175 (161 at Dec-24 end); AVL expects adding 25-30 stores in FY26. Bihar/Jharkhand/UP contributed 80%/12%/8%, respectively, to the annual topline. After developing a strong presence in eastern UP cities like Varanasi, Prayagaraj, Ayodhya, and Gorakhpur, AVL is now turning focus toward central UP, where it has opened 10 stores, including 6 in capital-city Lucknow. EBITDA margin was down by 130bps to 8.7%, due to a 50bps dip in gross margin and higher employee/operating costs due to accelerated pace of store additions (~50% of new stores in FY25). AVL has maintained its annual margin outlook of 13-15% gross margin and 8-10% EBITDA margin vs reported gross margin of 15.7% and 9% EBITDA margin in FY25.

AVL expects the increase in capex/WC investment to offer a better experience

AVL expects rise in capex, WC per store, and store breakeven period. New capex is Rs7- 8mn/store (vs Rs6-7mn earlier), with revised WC at Rs27.5-30mn/store (Rs22.5-25mn earlier), and store breakeven at 7-9 months now vs 6-8 months earlier. AVL believes the increase was led by focus on opening of larger-format stores (~5,500sqft store area vs ~4,000 earlier); the store size increase is aimed at offering more products on display, to match consumer experience (vs competition) in high-density stores and on account of cost inflation. The management was optimistic about such stores faring considerably well.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)