Buy Safari Industries Ltd For Target Rs. 2,737 by Centrum Broking Ltd

Safari Industries’ Q4FY25 print came in line with our estimates; revenue grew by 15.2% YoY on the back of solid ~22% YoY volume growth. Majorly growth came from the E-commerce followed by MT while GT & CSD were muted. We expect Safari’s revenue momentum to continue to be ahead of industry, led by: (1) ~70% contribution from hard luggage (2) rising consumer traction through NPD (3) higher premium sales (Rs1bn on ARR; would reach Rs2bn by FY26E) and (4) E-commerce (~40% sales) would continue ~20%+ growth across product segments. Gross margin contracted by 140bps YoY to 49.2% due to higher discounts in e-commerce/MT while QoQ it improved by 380bps on the back of lower discounts, start of Jaipur plant and lower RM costs. EBITDA declined by 9.0% YoY to Rs609mn due to higher employee cost (+29.4% YoY) and elevated other expenses (+22.4% YoY). We expect the Jaipur unit to reach +75% CU by Sept’25, which has the potential to clock Rs10bn at fully utilization. Further, margins would reach normal levels (Gross margin/EBITDA margin: ~45-47%/~14-16%) as VIP’s old inventory is expected to be liquidated by H1FY26. Considering the weak FY25 performance, we tweaked our earnings estimates and maintained BUY with a revised target price of Rs2,737 (52x FY27E EPS).

Industry witnessed moderate demand; Safari delivered ~22% YoY volume growth

Safari’s revenue grew by 15.2% YoY to Rs4.2bn in Q4FY25, backed by solid ~22% YoY volume growth (majorly from E-com channel). We expect Safari’s revenue momentum to continue to be ahead of industry, led by: (1) ~70% contribution from hard luggage (2) rising consumer traction through NPD, (3) supply support from Jaipur unit and (4) higher premium sales (Rs1bn ARR) to reach Rs2bn by FY26E. We expect the Jaipur unit to reach +75% CU by Sept’25, which has the potential to clock Rs10bn at fully utilization. With increased back-end manufacturing at Jaipur, the company has cut its dependency on Chinese imports and the management remains upbeat about revenue growth momentum with ~15-17% volume growth expected for the next 3-5 years.

Higher discounts in MT/E-com dent margins; sequential improvement observed

In Q4FY25, gross margin declined by 140bps YoY to 49.2% while QoQ it improved by 380bps on the back of lower discounts and reduced RM costs. EBITDA declined by 9.0% YoY to Rs609mn due to higher employee cost (+29.4% YoY; on addition of new plant’s manpower) and other expenses (+22.4% YoY), led by ~7.5% increased spends on advertising. Higher A&P spend was seen on E-com/Urban Jungle (Rs50mn) during Q4FY25. EBITDA margin moderated to 14.5% (down 380bps YoY) and EBIT was down by 14.5% at Rs454mn due to higher depreciation (+12.6% YoY). We expect margins to reach normal levels (Gross margin/EBITDA margin: ~45-47%/~14-15%) as VIP’s old inventory is expected to be liquidated in the next 3-4 months. Going forward, we expect ~200bps margin expansion over the next couple of years on the back of operating leverage and lower discounting.

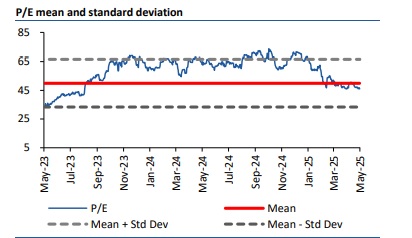

Valuation and key risks

We expect Safari’s growth momentum to be driven by: (1) focus on in-house manufacturing, (2) scale-up of its retail footprint for the Urban Jungle brand and (3) gain in market share from the unorganised segment. We remain sanguine about Safari’s growth story, although rising competitive intensity from the organised players in soft luggage might dent its growth. After considering lower FY25, we have tweaked our earnings estimates and maintained BUY rating with a revised target price of Rs2,737 (52x FY27E EPS). Risk: Higher RM costs and higher discounting by regional competitors.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331