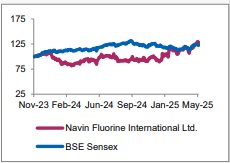

Hold Navin Fluorine International Ltd for the Target Rs. 4,440 by Axis Securities Ltd

Strong Result; Positives Largely Factored in Rich Valuation

Est. Vs. Actual for Q4FY25: Revenue: INLINE; EBITDA: BEAT; PAT: MISS

Change in Estimates post Q4FY25

FY26E/FY27E: Revenue: 1%/2%; EBITDA: 1%/8%; PAT: -5%/3%

Recommendation Rationale

NFIL delivered robust, broad-based performance during the quarter, along with a notable recovery in margins. The management remains optimistic about sustaining growth momentum.

* Strong Momentum in CDMO: The CDMO segment reported a 141% YoY increase in revenue, supported by a healthy order book ensuring strong revenue visibility. The cGMP4 capex of Rs 288 Cr is progressing as planned, with Phase 1 of the facility expected to be commercialised by Q3FY26. The European CDMO business continues to advance, with new molecule orders secured for FY26 deliveries. Management reiterated its CDMO revenue guidance of USD 90–100 Mn, backed by the Fermion contract and growth from both new and existing molecules across development stages, aligned with the cGMP4 capacity expansion.

* HPP Growth Driven by Volume and Pricing: The HPP segment posted a 10% YoY increase in revenue, led by higher volumes and improved realisations. The company successfully commercialised additional R32 capacity in Mar’25, which is now running at optimal levels. Management highlighted sustained demand and favorable pricing trends for both HFOs and R32s.

* Strong Visibility in Specialty Chemicals: NFIL is operating at optimal capacity at its Dahej and Surat plants, with a strong order pipeline for FY26. Following successful validation from global agrochemical partners, the company is set to launch two new fluoro-intermediates for their innovative AI in FY26.

* Strategic partnership with Chemours and Buss ChemTech AG: NFIL partnered with Chemours to manufacture its proprietary product Opteon, a two-phase immersion cooling fluid. This manufacturing partnership leverages Chemours' innovation and Navin's manufacturing expertise to address the data cooling center needs created by AI and nextgeneration chips. Additionally, NFIL have also tied up with Buss ChemTech AG (Switzerland) as a technology partner to commercialise solar and electronic-grade HF.

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: The company continues to add capacities and is also focused on maximising capacity utilisation, enhancing productivity, and driving efficiencies across all businesses. The order book reflects strong revenue visibility across all three segments over the short to medium term. With ongoing expansion, new molecule launches, and anticipated tie-ups in the CDMO space, the company is well-positioned to deliver strong performance in FY26 and FY27. The company has seen a steady improvement in margins in recent quarters, with potential for further improvement. However, the management mentioned that they will focus on maintaining current margins going ahead and has not given guidance for margin expansion.

Current Valuation: 30x FY27E (Earlier Valuation: 30x FY27E).

Current TP: Rs. 4,440/share (Earlier TP: 4,300/share).

Recommendation: While we are raising our target price, we downgrade the rating on the stock to HOLD from BUY as the valuation appears to have factored in the current growth prospects.

Financial Performance: Navin Fluorine International Ltd. (NFIL) reported strong Q4FY25 results. Revenue stood at Rs 701 Cr, up 16% YoY/QoQ, in line with our estimate of Rs 706 Cr. EBITDA rose sharply to Rs 179 Cr, up 62% YoY and 21% QoQ, exceeding our estimate of Rs 172 Cr by 4%. EBITDA margins improved to 25.5% from 18.3% in Q4FY24 and 24.3% in Q3FY24. PAT came in at Rs 95 Cr, up 35% YoY and 14% QoQ, slightly below our estimate of Rs 99 Cr.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ00016163