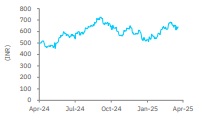

Accumulate Shriram Finance Ltd For Target Rs. 734 By Elara Capital

Risk-reward remains favorable

Shriram Finance's (SHFL IN) Q4 earnings although in-line were mixed on account of elevated credit costs and lower margin with tad lower business traction. Said that, excess liquidity on the balance sheet (INR 310bn) and increased debt (ECB: INR 336.5bn) towards fiscal end weighed upon NIMs. Disbursements at 14%+YoY run-rate indicated a tepid undertone, underpinned by sluggish underlying CV volumes with tad elevated delinquencies. MSME and personal loans (PLs) have witnessed a rebound, with non-vehicle finance share (19.7% of AUM) proving as a key catalyst to SHFL sustaining its AUM CAGR at 17%. On the asset quality front, while certain geographic credit risks exist, write-off and stage 2 pool are under control. Credit costs at 2.4% spiked 40bps QoQ, with write-offs climbing to INR 23.45bn, but the management’s confidence as regards achieving 2% credit cost in the near future may be EPSaccretive. For a high-return profile book, we maintain Accumulate at a raised TP of INR 734

PAT in line; higher provisions and liquidity strain margins: Q4FY25 PAT at INR 21.4 bn (as estimated), up 2.8% QoQ/9.9% YoY, was dragged by higher provisions (INR 15.63 bn, +17.9% QoQ). NII grew 3.9% QoQ/14.3% YoY to INR 60.5bn, while PPoP at INR 43.4bn was a slight beat (+6.1% QoQ/11% YoY). COB remained flat at 8.95%, with incremental cost at 8.86%, but there was a pressure on NIM, which contracted 23bps QoQ/77bps YoY, due to elevated liquidity of INR 310bn from ECB deals and inflating interest expenses. Attrition was steady, with a reduced team size reflecting improved productivity. FY26 NIM guidance is 8.4-8.6%, with a 25bps margin improvement expected as liquidity normalizes.

Broad-based growth as SHFL eyes 15%+ growth in FY26: In Q4FY25, disbursements rose 14.4% YoY to INR 448.48bn, and AUM grew 3.4% QoQ/17.1% YoY to INR 2.63tn. CV growth remained modest at 2.4% QoQ/10.9% YoY due to weak government capex, though replacement demand and used vehicle activity may drive 12-15% growth ahead. PL gained traction, rising 11.1% QoQ/7% YoY, with stress peaking and focus on low-risk 2W borrowers. Farm equipment (FE) grew 9% QoQ/40.1% YoY, while PV and Construction equipment (CE) rose 4.3% and 0.1% QoQ, respectively. MSME growth is expected to moderate to 20%+ YoY from 42% as the base effects ease; 70-80% of loans are property-backed with ticket sizes of INR 0.5-0.6mn and IRRs of 16-24%. Gold AUM declined 11.9% QoQ/23.2% YoY amid higher redemptions. FY26 growth is projected at 15%+, driven by macro conditions.

Maintain Accumulate; TP raised to INR 734: FY25 concluded on a mixed note for SHFL. While the concerns seem transient, margin trajectory and credit costs deceleration are key catalysts to incremental valuation trigger. While Q4 exhibited higher-than-anticipated credit costs, a revamped provision policy, confidence on curbing stage 2 flows and a 2% credit cost forecast may boost RoAs to 3% and RoEs to 17% in FY25-28E. We largely maintain our estimates and introduce FY28E. A resilient balance sheet prompts us to reiterate Accumulate with a raised TP of INR 734 (from INR 621), valuing SHFL at 1.9x FY27E P/ABV, which is the fair value multiple adequately factoring in positives and business risks, in our assessment

Please refer disclaimer at Report

SEBI Registration number is INH000000933