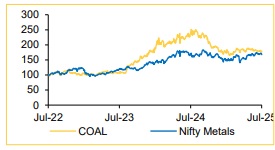

Buy Coal India Ltd For Target Rs. 290 By Choice Broking Ltd

Structurally Unattractive Play

We maintain our SELL rating on Coal India (COAL) with a TP of INR290/sh.

“Attractiveness” based on cheap valuation multiples is an optical illusion COAL trades at cheap valuation multiples of ~5x/9x/1x FY27E EV/EBITDA, P/E and EV/CE respectively. These headline multiples make the stock look attractive, but we believe it is a Value Trap as these metrics conceal more than they reveal.

The key pillars of our Investment Thesis that make us disillusioned on COAL: 1) Pricing - discounted pricing and unfavorable sales mix, 2) Huge capex, yet EBIT momentum will be negative - running on a treadmill kind of a situation, 3) Cash is restricted due to large long term provisions, and 4) Declining GCV across subsidiaries.

All FCF Post Capex is Paid as Dividends, hence DDM is our preferred method: COAL is a cash cow where all free cash flows post capex are paid out as dividends. We thus believe a realistic way to value COAL is to focus on its dividend paying potential; hence we use the classic Dividend Discount Model (DDM) to value the company

Valuation: We use a scenario based approach. Our Base Case Scenario TP (DDM-based) is INR 290/sh. Our Upside Scenario (10-15% probability event in our view) uses a mix of multiples and DDM for a value of INR 500/sh, while our Downside Scenario (10-15% probability event in our view) value is INR 225/sh (DDM-based).

At CMP COAL’s dividend yield is ~7%, which is optically high, but unattractive in the absence of other value drivers and doesn’t cover cost of equity of ~13%.

Risk to our SELL rating: A reversal in government policy to substantially align coal prices with a profit maximization motive is a risk to our SELL call.

Q1FY26: Better Than Expected Volume Mix Drives Marginally Better Result vs Street Expectations

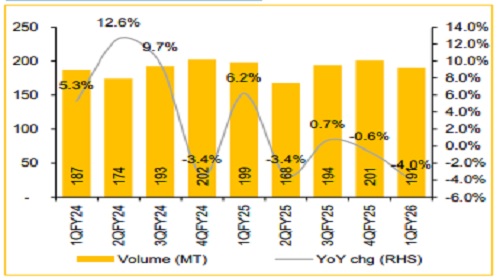

Sales Volume at 190.6MT (-5.0% QoQ, -4.0% YoY) – were pre reported, within which E-auction volume at 21.3MT (-1.3% QoQ, -8.1% YoY) was ahead of Choice Institutional Equities (CIE) estimates of 18MT, which is good.

FSA realization came in at INR 1,550/t (+0.1% QoQ, +1.7% YoY), higher than CIE estimate of INR 1,540/t. E-auction realization came in at INR 2,332/t (- 10.8% QoQ, -3.3% YoY), lower than CIE estimate of INR 2,500/t.

Revenue (incl OOI) came in at Rs358.4Bn (-5.2% QoQ, -1.7% YoY) higher vs CIE/street estimates of INR 354.6/350Bn mainly due to higher than expected other operating income and better volume mix.

EBITDA (ex- Stripping adj) came in at INR 111.2Bn (-0.9% QoQ, -3.6% YoY) which is ahead of CIE/street expectation in the range of INR 105-108Bn, largely due to revenue beat as the major cost lines were in line with estimates.

PAT came in at INR 87.4Bn (-9.0% QoQ, -20.2% YoY) ahead of street expectations in the range of INR 80Bn, but in line with CIE estimate of INR 86.6Bn.

Dividend of INR 5.5/sh has been announced which is largely in line with street expectation in our view.

Q1 sales volume down 4% YoY

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131