Add HCL Technologies Ltd For Target Rs. 1,580 By JM Financial Services

Back on track

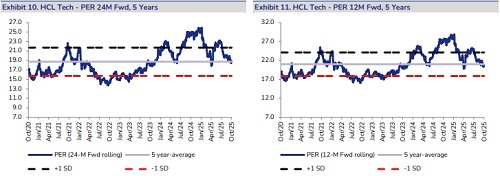

HCLT’s 2Q performance ticked most boxes. Revenues grew 2.4% cc QoQ, beating JMFe: 1.2%. Growth construct was better too with core Services segment (+2.5% cc QoQ; JMFe) driving the beat. Even in Software, growth was stronger in annuity revenues (Subs/Support) even as lumpy perpetual licenses dragged. Despite the mix (lower software), margins were better (17.4% vs JMFe: 17.1%). Deal wins were higher (Net new: USD 2.6bn; +16% YoY) and granular (no mega deals). Advance AI revenues, disclosed for the first time, are clocking USD 400mn ARR. HCL is doubling down on its AI proposition (AI Force/AI Factory) with strengthened GTM, AI advisory and expanded partnership ecosystem. These are helping HCL win deals, though at the expense of revenue deflation in core services at times. HCLT’s confidence of stepping up its quarterly net new TCV run-rate to USD 2.5bn+ (from USD 2bn) should offset this deflation. We will however seek more consistent TCV print to build growth acceleration. Besides, modest ask rate (0.3-1.5% CQGR in 2HFY26 for Services), lag between TCV pick-up and revenue conversion and unchanged consol. revenue guidance (3-5%) limit changes to our FY26-28E revenues. Moreover, increase R&D spend (on IPs) and mix change (lower Software) offset 2Q beat on margins. Our FY26-27E EPS is therefore little changed. HCLT is leveraging its strengths in engineering, infrastructure and software to make good strides in AI-centred services. Those should help it navigate AI’s deflationary impact better than peers, in our view. 8% upmove since our upgrade and limited earnings upgrade however limit upside. We retain Add.

* 2QFY26- Strong well rounded performance: HCLT’s 2QFY26 topline beat expectations. Revenue grew 2.4% cc QoQ vs. JMFe/Cons. est. of 1.2%/1.5%. IT and Business Services was strong (2.6% cc QoQ) – Lifesciences and healthcare/Public services led with 4.4%/7.8% QoQ growth (USD). Products and platforms growth was soft at 0.5% cc QoQ (-3.7% YoY) offsetting some of the strength in services. Softness in products was due to decline in perpetual license revenue as the company shifts its focus towards subscription. EBIT margins expanded 116 bps QoQ to 17.4% vs JMFe/Cons. est. of 17.1%. Increased margins in software (+30bps), absence of one-off impact (+30bps), higher utilization (+50bps), FX (+56bps) aided margins partially offset by restructuring (-55bps). PAT came in at INR 42.4bn, marginally missing expectations (vs JMFe/Cons. est. of INR 43.2/43bn). LTM FCF/PAT was 125%.

* Guidance-Unchanged: HCL won USD 2.57bn net new TCV, +16% YoY. LTM TCV grew at 13% YoY. The company closed two of the large deals which spilled over from Q1, thus exceeding USD 2.5bn mark without any mega deal. HCLT maintained its FY26 cc guidance for total revneue (3-5%) and raised the lower end of the guidance for services from 3-5% to 4-5%. Guidance implies CQGR of 0.3-1.5% for Services through 3Q-4QFY26. Confidence in the closed bookings, along with a strong pipeline, is informing management’s guidance. The company maintained its EBIT margin guidance at 17-18%. Q3/Q4 is expected to see 70-80bps/40-50bps impact due to wage revisions. Restructuring expenses are expected to continue in Q3 and might spill into Q4. Restructuring led margin gains could be offset by higher investments, therefore margin rebound in FY27 could be limited, in our view.

* Minimal changes in estimates; Maintain ADD: We have revised our revenue estimates by (49)- 45bps over FY26-28E. Services and ER&D revenue estimates have been increased while products’ has seen a decrease. Our EBITDA margin estimates are unchanged despite 2Q beat. We expect higher R&D spend – as the company invests in IPs – and mix change (lower software) could impact margins. Our EPS has been revised by (0.7%)-2.1%. Maintain ADD.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361