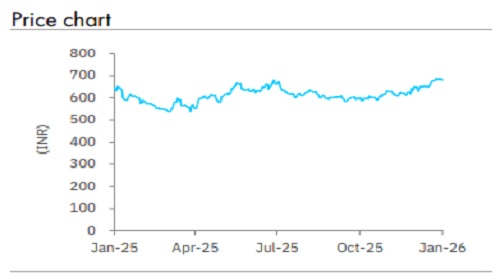

Accumulate ICICI Prudential Life Insurance Ltd for Target Rs 730 by Elara Capitals

In-line Q3

ICICI Prudential Life Insurance (IPRU IN) reported a mixed Q3FY26, with annualized premium equivalent (APE) growing ~3.6% YoY to INR 25,250mn, driven by strong growth in retail protection (supported by GST tailwinds) , though partially offset by decline in group APE due to lumpiness and a high base in group funds. Growth was supported by an 8. 2% YoY rise in linked (ULIP) products , and 15.0% YoY in non -linked savings as customers locked in yields, though annuity declined 16.4% YoY from a high base. We expect APE growth of ~2% in FY26E, with recovery to continue in Q4 driven by channel diversification , product launches and tailwind s in term . We expect FY26E VNB margin of 24. 5%, resulting in absolute VNB growth of ~ 9.6% in FY26E. We maintain Accumulate on IPRU with TP raised to INR 730 .

Protection leads growth; ULIP recovers, non-linked savings strong: Protection delivered robust growth of ~18.7% YoY in Q3 and 10.7% YoY in 9MFY26, led by retail protection surging 40.8% YoY in Q3 (20.9% in 9M), driven by pure term plans (85 -90% of mix) benefiting from GST reforms. ULIP recovered with 8.3% YoY growth in Q3 amid stable equity markets, supported by high sum assured plans for long -term wealth creation and goal protection. Margin - accretive non -linked savings grew a healthy 15.2% YoY in Q3 as cus tomers locked in yields in a declining rate environment, while annuity declined 16.4% YoY from a high base though single premium variants remained attractive. Group funds saw a sharp 43.5% YoY decline due to lumpiness and high base. We expect retail term momentum to sustain as product affordability improves.

VNB margin remains resilient at 24.4% in 9MFY26 (up 160bps YoY), supported by a favorable product mix shift towards higher -margin retail protection and benefits from higher sum assured ULIPs amid equity market stability. Positive yield curve movements helped offset the impact of GST input tax credit withdrawal on individual business, while overall VNB grew 5.7% YoY , despite modest APE decline of 1.4% YoY in 9MFY26 . IPRU remains focused on growing absolute VNB, with product -level margins and mix changes expe cted to drive future APE recovery and

Embedded value (EV) could face some pressure from negative operating variances, primarily due to persistency trends (13M persistency at 84.4%, down from 89.8% YoY) and potential drags from annuity business persistency. Management is focused on sustain ing ROEV, with our expectation at ~ 13% for FY26E, supported by ongoing VNB delivery and risk management despite these headwinds.

No incremental triggers – Maintain Accumulate with a higher TP of INR 730: We maintain Accumulate with a raised TP of INR 730 (from INR 690) as we roll forward by a quarter. Our TP is based on 1.6x Dec -27E P/EV, factoring in ~8% VNB CAGR in the next 10 years (12.5% cost of equity, 5% terminal growth, RoEV ~13%) . We largely retain our core estimates, with minor revisions .

Please refer disclaimer at Report

SEBI Registration number is INH000000933