Buy DLF Ltd For Target Rs. 1,000 By JM Financial Services

Sharp scale-up in cash flows

DLF hosted an analyst meet highlighting recent performance and outlook across the residential and annuity businesses. With respect to the residential business (DevCo), the management intends to maintain the current sales run-rate (c. INR 200bn, as the pipeline of INR 739bn gets launched) and work towards successfully executing these projects. With healthy 45%+ blended gross margins on the identified pipeline, management expects 2x growth in PAT and cash flows by FY30E. Over the medium term, DLF also intends to distribute 50% of the PAT as dividends and become net debt free at the group level. Management has further firmed up their plans to accelerate expansion of the annuity portfolio. The planned capex of INR 200bn will expand the portfolio size to 73msf with exit rentals of INR 100bn by FY30E– 2x growth from current levels. In our view, the steady growth in annuity business will be complimented by high margin residential segment having a high quality land bank, sufficient for growth over the next 20 years. DLF remains one of our preferred picks in the real estate sector and we maintain BUY with SoTP based TP of INR 1,000. Key risks: slowdown in residential / commercial segment.

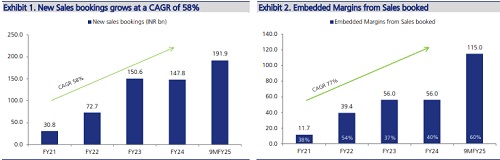

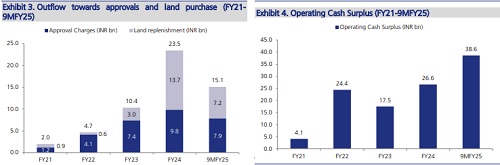

* Expect steady sales with sharp scale-up in cash flows: Since FY22, DLF has significantly scaled up the bookings from INR 71bn to a significantly higher level of INR 200bn in FY25. This was led by the sell-out response to most of the new launches across categories. Management now intends to maintain the current sales run-rate (c. INR 200bn, as the pipeline gets launched) and work towards successfully executing these projects. With this high margin (gross margins of 45%+) residential land monetisation, cash flows could accelerate going ahead. As per the management, INR 190bn of cash flow is already tied up from sold units and further inflow of INR 240bn is estimated from unsold inventory in launched projects over the medium term (totalling INR 430bn). Netting off the overheads along with capex for rental assets and taxes, the launched pipeline can create FCF of INR 250bn, while the pipeline can also generate and FCF of INR 240-260bn, leading to total cash inflow of INR 500bn.

* Captive land bank has vast potential: DLF has re-assessed the TOD/TDR potential and it now expects the captive land bank to have development potential of c. 196msf (v/s 169msf earlier) of which c. 52msf is either under execution or part of identified launch pipeline, thereby leaving signficiant potential of c. 144msf for future development.

* Going full throttle in annuity: The DLF group currently has a c.44msf (incl. JV share) annuity portfolio, while another c. 8msf is nearing completion which includes Downtown (Gurugram and Chennai), Atrium Place and boutique retail malls in NCR and Goa. DLF has unveiled the upcoming pipeline of c. 21msf including c. 14.4msf office and c. 6.3msf retail development. Management expects a capex outlay of INR 200bn and these assets can potentially add incremental rental income of INR 50bn which translates into a robust 25% yield on cost (excl. land). By FY30E, the size of annuity portfolio should increase to 73msf with INR 100bn rental potential – 2x growth from current levels.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361