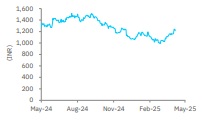

Accumulate Godrej Consumer Ltd For Target Rs. 1,350 By Elara Capital

Foundation set for strong growth

While near-term margin may be strained by inflation in palm oil, strong performance in the non-soap India portfolio and international business is encouraging. Thus, Godrej Consumer (GCPL IN) aims to achieve high single-digit revenue and double-digit EBITDA growth in FY26. The new HI formulation delivered stellar results in Q4 and is expected to sustain momentum. In light of structural improvements, we raise our target P/E to 50x (from 48x) and revise our TP to INR 1,350. Maintain Accumulate.

Volume growth hit by inflation in soaps: Q4 net sales grew 6.3% YoY to INR 36bn (1.1% below our estimates) as the India business grew 8% in value and 4% in volume, led by 14% growth in home care and 4% in personal care. However, volume growth was tempered by pricevolume rebalancing in soaps amid rising palm oil costs. The non-soaps portfolio delivered high single-digit volume growth, led by double-digit growth in household insecticides (HI) and fabric care. For FY25, India volume growth stood at 5%, falling short of the high-singledigit target due to ongoing softness in demand and inflationary pressure in soaps. Internationally, Indonesia posted a 6% volume growth in FY25, as guided. In contrast, GAUM (Africa, US, and the Middle East) posted a volume drop in FY25 owing to structural corrections in trade pipelines but rebounded with a 12% volume growth in Q4 after the correction concluded in Q3.

GCPL aims to improve performance in FY26: GCPL targets stronger performance in its India business in FY26, aiming for mid-to-high single-digit volume growth, on robust gain in HI— especially incense sticks (25% market; GCPL leads with 8% share) and the newly-launched liquid vaporizer. In its newer portfolio, GCPL expects strong double-digit growth led by innovation (air care), democratization (fabric care, deodorants), distribution expansion (sexual wellness, deodorants), and product upgrade (hair color: powder to crème). Internationally, GCPL looks to sustain high single-digit growth in Indonesia and drive profitable hair care-led growth in GAUM, while expanding portfolio with successful products from other markets. Overall, it expects consolidated sales to grow in high single-digit.

Weak India margins weigh on profitability: In Q4, GCPL’s consolidated EBITDA margin declined 120bps YoY to 21.1%, though still 100bps above estimates. This was led by a 400bps drop in India margins, partly offset by a 290bps gain in international business. FY25 margin for India business stood at 23.6%, below its normative 24-27% range due to inflation in palm oil, but the management expects recovery in the next 2–3 years as the new portfolio scales up. Margin expansion in the international business is structural (GAUM at 15% versus 9% historically), driven by simplification and exit from unprofitable segments. The management targets a steady improvement in international business margins, from 16.6% in FY25.

Maintain Accumulate with a higher TP of INR 1,350: We marginally trim FY26E estimates but raise FY27E estimates by 2.8% on stronger profitability. We maintain Accumulate with a higher TP of INR 1,350 (earlier INR 1,260), valuing at 50x FY27E P/E (up from 48x) on structural improvements across India and international markets. We introduce FY28E estimates.

Please refer disclaimer at Report

SEBI Registration number is INH000000933