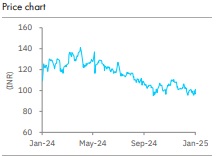

Accumulate Punjab National Bank Ltd For Target Rs. 113 By Elara Capital Ltd

Good quarter; still a long way to go

Punjab National Bank (PNB) Q3FY25 PAT of INR45bn surpassed estimates on lower credit cost (despite creating floating provisions) and some writebacks. Asset quality sustained its improvement, with NNPL at a mere 41bp – a commendable feat, in our view. NIM held up by 1bp QoQ, better than peers, but it had an element of interest on IT refunds. Core operating performance (excluding one-offs) remains volatile and scores below peers.

The key discussion hereon is whether there is scope for improvement in core metrics or are these closer to the peak? Also, consistency in core PPOP is yet to be established and profitability is still soft albeit improving. ROE of 10-12% even by FY27E would run lower than peers?. We retain Accumulate with a TP of INR 113 (unchanged).

Asset quality better-than-expected; keenly monitoring FY26 trajectory:

PNB continues to deliver on improving asset quality with slippages curtailed at INR 17.7bn (73bp of lagged loans). This along with sustained recovery trends has led to a further dip in GNPL to 4.1%, the lowest in the past several quarters. Commendably, the bank currently has NNPL of 41bp. While steady improvement was visible, performance hereafter will be a key monitorable, given the shrinking recovery pool for FY26 (more recoveries can come for FY25).

Core performance needs further leg up; limited levers cause for concern:

Q3 saw better-than-expected loan growth momentum, up 4.6% QoQ; this along with steady NIM helped NII, up 4.9% QoQ. That said, NIM had benefitted from interest on IT refund, excluding which it would have declined by 8-10bp. While we may see NIM improvement in Q4, it remains below peers and an area that warrants a watch. The turning rate tables would further impact NIM. Core operational performance (excluding one-offs) may still lag, and thus the road to recovery could be slightly stretched.

Reiterate Accumulate with a TP of INR 113:

While performance seems to be improving, it was supported by higher recovery trends and some write-backs – Q3 reinforces our view. The investment argument thus relies on recovery potential than on core delivery, which we believe still has some catching up to do.

Stepping into FY27, we believe a lot needs to be done on core performance. Improvement hereafter may be contingent on persistent tailwinds. We retain Accumulate with TP of 113 (on 1x September’2026 P/ABV).

Please refer disclaimer at Report

SEBI Registration number is INH000000933