Buy AXIS Bank Ltd For Target Rs. 1,330 By JM Financial Services

In 4QFY25, Axis bank reported an inline performance with PAT growing (+13% QoQ, flat YoY, +9% JMFe). Beat was largely driven by lower-than-expected credit costs at 0.5% (vs. 0.86% QoQ), aided by the reversal of excess provisions worth INR 8bn related to SRs that were transferred to the NARCL. Additionally, interest income of INR 5bn on these SRs is yet to be recognized and will be accounted for upon realization. Asset quality improved during the quarter, with gross and net slippages moderating to 1.9% and 0.8%, resp. (-28bps QoQ/ -61bps QoQ). Mgmt. highlighted that they have further tightened provisioning norms, which may result in a marginal uptick in slippages in FY26. Despite tight liquidity conditions, deposit growth remained robust at (+7% QoQ, +10% YoY). While credit growth improved sequentially (+3% QoQ), it continued to trail system-level growth. Margins were largely stable (+4bps QoQ), as uptick in CoFs (+4bps QoQ) was offset by a similar inch up in yields. With easing liquidity conditions and credit costs likely to remain benign, we expect a further acceleration in growth in the coming quarters. Core bank currently trades at 1.5x FY27E BVPS, and we believe further re-rating will hinge on growth acceleration. We expect avg. RoA/RoE of 1.6%/14% over FY26E-27E. Maintain BUY with a revised TP of INR 1,330 (valuing core bank at 1.6x FY27E BVPS).

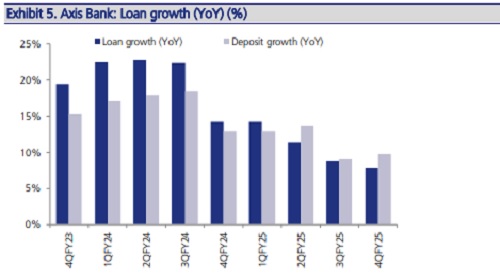

* Deposits outpace credit growth: In 4QFY25, deposit growth was robust (+7% QoQ, +10% YoY), led by CASA (+11% QoQ), followed by TD (+5% QoQ). Consequently, CASA ratio improved to 40.8% (vs 39.5% QoQ). Loan growth also picked up sequentially (+3% QoQ), though it continued to lag system-level credit growth. Growth in advances was led by SME loans (+4% QoQ), followed by retail loans (+3% QoQ) and corporate loans (+2% QoQ). Within retail, growth was driven by LAP portfolio (+8% QoQ) and rural loans (5% QoQ). Growth in unsecured portfolio remained muted, with PL (+2% QoQ) and CC (flat QoQ), as the bank remained cautious amid ongoing asset quality concerns in this segment. CD ratio moderated to 89% (vs 93%). Mgmt. indicated that while asset quality in the credit card portfolio has largely stabilized, the personal loan segment may take a few more quarters to normalize. We build in loan CAGR of 12% and deposit CAGR of 12% over FY25-27E.

* In-line operating performance: Operating profit grew by (+2% QoQ, +2% YoY, in-line JMFe) on the back of a) steady NII (+2% QoQ, +6% YoY) and b) robust non-interest income (+14% QoQ) led by strong fee income momentum (+16% QoQ). Mgmt. indicated that the increase in operating expenses was largely due to higher PSLC costs, amounting to INR 5.91bn. Reported NIMs remained stable at 3.97% (+4bps QoQ), benefiting from a slight uptick in yields, which offset the rise in the cost of funds (+4bps QoQ).

* Asset quality improves: Gross slippages/net slippages moderated to 1.9%/0.8% (-28bps QoQ/-61bps QoQ). Credit costs decreased to 0.5% (vs. 0.86% QoQ), primarily driven by a INR 8bn write-back in provisions related to SRs on loans transferred to NARCL. Mgmt. noted that they have further tightened provisioning policies for certain products, which could lead to a marginal increase in slippages in FY26. Additionally, early indicators suggest that asset quality in the credit card portfolio has largely stabilized, while personal loans are expected to take a few more quarters to normalize. We build in avg. credit costs of 0.84% over FY26E-27E.

* Valuation and view: Axis has delivered an inline outcome this quarter, marked by an improvement in credit costs and early signs of a pick-up in growth momentum. With liquidity conditions expected to ease and credit costs likely to plateau, we expect a further acceleration in growth in the coming quarters. Core bank currently trades at 1.5x FY27E BVPS, and we believe further re-rating will hinge on a more meaningful acceleration in growth. We expect avg. RoA/RoE of 1.6%/14% over FY26E-27E. Maintain BUY with a revised TP of INR 1,330 (valuing core bank at 1.6x FY27E BVPS).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)