Buy Titan Company Ltd For Target Rs.4,026 by Centrum Broking Ltd

Higher GC & lower studded impacted margin

Titan’s Q3FY25 print was in-line with our estimates while higher gold coin sales & lower studded have impacted margin. Console. Revenue/EBITDA grew at 25.2%/7.0% while PAT declined by 0.6% respectively. Jewelry division (excluding bullion sales) reported strong growth of 26.6% led by wedding related purchases (29% YoY growth) and healthy same store sales growth of 22% YoY (higher growth in South & East followed by North & West). Management alluded this to, (1) higher gold sales led by lower custom duty, (2) strong buyer growth (48% new buyer) in lower ticket size (

Domestic jewelry business grew 26.6% (excluding bullion) with 22% SSSG

Consolidated revenue in Q3FY25 grew by 25.2% to Rs177.4bn largely led by festive/wedding season. Segment revenue growth: Jewelry (Excluding bullion sales) Rs161.3bn (+26.6%), Watches Rs11.4bn (+15.3%), Eyewear Rs2.0bn (+16.7%), others Rs3.1bn (-0.3%). Management alluded this to, (1) higher gold sales led by lower custom duty, (2) "fairly good ticket size growth" driven by repeat customers and (3) double digit growth in watches. With 1194 stores, W&W, sales at Rs11.4bn driven by strong growth of 20% YoY in analog watches whereas Eyeware division grew by 16.7% to Rs2.0bn led by healthy double digit volume growth. Caratlane grew 27% to Rs11.1bn led by 24% growth in studded category. Management believes strong jewelry sales would continue while competitive intensity would be higher in the short term.

Gross margin lowered at 20.6% due to higher gold coins along with lower studded mix

Gross margin lowered by 264bps to 20.6% due to higher gold coins sales along with lower studded mix of 23%. EBITDA at Rs16.7bn, increased +7.0% despite higher other exp. (+16.0%), Employee cost (+15.6%) and Ad spends (+9.8%), EBITDA margin at 9.4% (-161bps). Jewelry segment EBIT margin declined to 9.2% (-240bps) due to (1) one time custom duty loss of Rs2.5bn, (2) lower studded mix of 23% & (3) higher gold coin purchases. W &W EBIT margin came at 9.5% (+382bps) while management expects sustainable margin would be ~13-14%. Management maintained the EBIT margin guidance of ~11-11.5% on standalone levels in FY26E.

Valuation driven by future revenue growth potential

We remain upbeat on Titan’s topline performance led by strong demand across business segments yet its footing in the international market appears to be promising. We reckon Titan’s strategy revolving around serving millennials, meeting their aspirational demand with introduction of new designs and channels, yet rising share of wedding jewelry could pay richly. The turnaround in the Caratlane, W & W, and eyewear divisions and continuity in their profitability potential need to be watched. Management maintained the standalone EBIT guidance of ~11-11.5% while we believe competition intensity would be higher on the short term. By looking lower 9MFY25, we cut our earnings for FY25/FY26 by 16.0%/4.1% and retain BUY rating with a DCF-based TP of Rs4,026 (implying 47.6x 27E EPS). Risks: irrational competition; lower demand and rising gold prices.

Valuations

We remain upbeat on Titan’s topline performance led by strong demand across business segments yet its footing in the international market appears to be promising. We reckon Titan’s strategy revolving around serving millennials, meeting their aspirational demand with introduction of new designs and channels, yet rising share of wedding jewelry could pay richly. The turnaround in the Caratlane, W & W, and eyewear divisions and continuity in their profitability potential need to be watched. Management maintained the standalone EBIT guidance of ~11-11.5% while we believe competition intensity would be on the higher side. By looking lower 9MFY25, we cut our earnings for FY25/FY26 by 16.0%/4.1% and retain BUY rating with a DCF-based TP of Rs4,026 (implying 47.6x 27E EPS). Risks: irrational competition from regional players; lower demand and rising gold prices

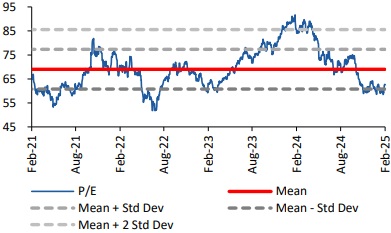

P/E mean and standard deviation

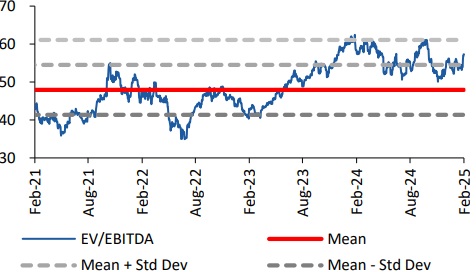

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331

.jpg)