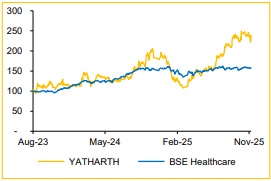

Buy Yatharth Hospitals Ltd for the Target Rs.1,050 by Choice Broking Ltd

Targeted Delhi-NCR Expansion to Propel Growth: YATHARTH’s focussed expansion across underserved areas of Delhi-NCR, combined with its strong super-specialty portfolio, is propelling higher ARPOB and sustaining healthy margins, reinforcing its position as a leading advanced tertiary-care provider.

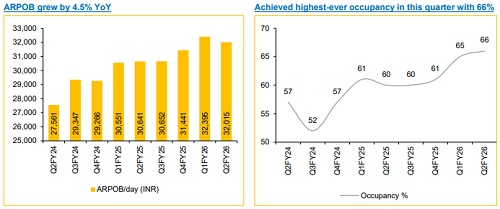

View and Valuation: We project Revenue/EBITDA/PAT to expand at a CAGR of 35.5%/35.7%/43.6% over FY25–FY28E. Upgrading our valuation multiple to 20x EV/EBITDA (from 17x) on the average of FY27–FY28E, we revise our target price to INR 1,050 (earlier INR 850) and maintain our BUY rating. We expect growth to be driven by higher ARPOB (8–10% growth every year), improved occupancy levels (aiming for 70% across existing facilities), strategic acquisitions and a sustained revenue growth trajectory of +30%.

Strong revenue, muted profitability in this quarter

* Revenue grew by 28.3% YoY and 8.4% QoQ at INR 2.8 Bn (vs CIE estimate of INR 2.9 Bn)

* ARPOB grew by 4.5% YoY to INR 32,015, with occupancy at 66%.

* EBITDA grew by 18.1% YoY and flat on QoQ at INR 0.6 Bn, with margin contracting 200bps YoY and 193bps QoQ at 23.1% (vs CIE estimate of 25.2%).

* PAT grew by 33.3% YoY and de-grew by 1.9% QoQ to INR 0.4 Bn (vs CIE of INR 0.5 Bn).

Strategic expansion propels Northern India footprint and doubling of capacity: Q2FY26 saw a strong network expansion with over 700 new beds added through the launch of Model Town (New Delhi) and Faridabad Sector-20 hospitals, which temporarily impacted profitability. Despite bed additions, occupancy stood at 66% in Q2FY26 as compared to 60% in Q2FY25. Within just an full year of operations, Greater Faridabad now contributes 10% to the group's revenue in Q2FY26. A key catalyst is the acquisition of Shanti Ved Hospital in Agra, an EBITDA-positive, 250-bed facility which will begin contributing meaningfully from day one of integration in Q4FY26. With ~INR 1,500 Cr capex planned over the next 4.5 years, the company is accelerating its presence in high-value Northern India markets, supporting a positive outlook driven by scale expansion and improving ARPOB by 8–10% every year.

YATHARTH achieves highest-ever quarterly results; FY26 growth to surpass 30%: YATHARTH delivered a strong performance in Q2FY26, achieving its highest-ever revenue and EBITDA. Financial flexibility was restored as income tax authorities unfroze provisionally attached properties and fixed assets. The company is optimistic about sustaining its growth trajectory, projecting that it will easily overachieve the 30% revenue growth in FY26. A critical, long-awaited industry development, the CGHS rate revision is expected to significantly enhance the company's revenue realisation and profitability. Management projects a conservative estimate, anticipating a minimum of a 1.5% incremental revenue benefit in FY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)