Monthly Market Outlook & Presentation November 2025 by SBI Mutual Fund

Global asset class performance and India’s position

* 2025 has witnessed a broad-based performance across multiple asset classes, with developed and emerging market equities, EM fixed income, and both precious and industrial metals delivering healthy returns.

* Year-to-date, Brent crude, the US dollar, and global food prices have been among the few key asset classes posting negative returns.

* In India, equities staged a notable comeback in November, likely supported by strong earnings. The NIFTY index rose approximately 11% year-to-date.

* Year-to-date, global equities and global fixed income have significantly outperformed Indian markets.

* Returns from Indian equities and fixed income at the index level have remained broadly similar so far.

Tariffs and their ripple rffects: Inflation, Investment, and Geopolitics

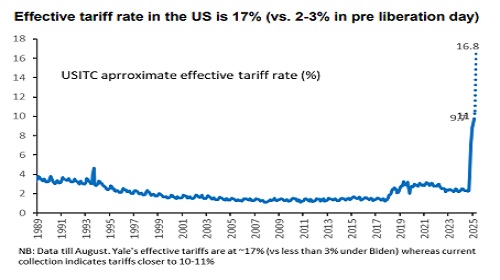

* Eight months have passed since April 2nd – Liberation Day. A Harvard study concludes that most tariff-related costs have been absorbed by U.S. importers and consumers, which remains incrementally negative for U.S. growth.

* Tariffs have added about 0.7% to U.S. CPI. Without tariffs, inflation would have been closer to 2.3% instead of 3%.

* Average effective tariffs are estimated at 17% by Yale Lab, while current collections suggest 10–11%.

* Tariffs seem to be stabilizing, but U.S. CPI could rise into 2026. Ahead of midterm elections, Trump may seek to ease tensions and reduce inflationary pressures, though disputes could flare up later.

* Impact on investment is unclear. Non-AI gross fixed capital formation is stagnating, and commitments to future investments remain vague (source: Macquarie Research).

* Geopolitically, the U.S. has retreated from talks with Mexico and Canada. ChinaU.S. relations remain tense, U.S.-EU ties have weakened, and even allies like Japan, Korea, and Australia show signs of hedging. Trade policies appear to have eroded U.S. influence and accelerated global fragmentation.

* In summary, tariffs have stabilized at lower-than-feared levels, with costs borne by U.S. importers and consumers. Other policies such as kickbacks, industry protection, and immigration are eroding key pillars of U.S. exceptionalism. Investors are likely to keep hedging USD exposure.

* Unless global imbalances are addressed, such developments may define the current era. To shrink its current account deficit, the U.S. will need a weaker dollar (especially against China) and slower growth.

Geopolitical shifts will continue: Root cause of the problem is economic imbalance

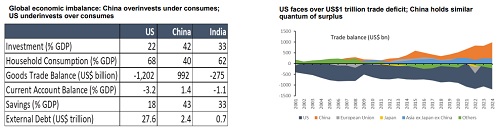

* The tariff issue highlights the deeper economic imbalance between the U.S. and China.

* US runs an annual trade deficit of ~US$1 trillion and China runs a similar quantum of surplus. Hence, US absorbs most of the worlds' surplus output of goods. This has led to rising levels of US overseas indebtedness. US administration wants to address this imbalance.

* China invests more than it spends while US consumption runs far higher than its investment. US acts as a consumer of last resort.

* The level of indebtedness in the US economy is rising to levels, which is perhaps getting difficult to sustain.

* Trump administration has initiated a fundamental debate- which is here to stay. There is a likely changing global order in the offing. Without robust demand from the US, global trade volumes may remain uncertain—unless China or the European Union undertakes substantial fiscal stimulus to boost demand.

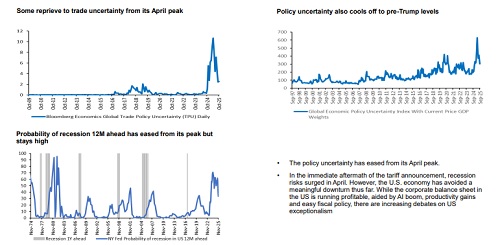

Some near-term de-escalation in global uncertainty

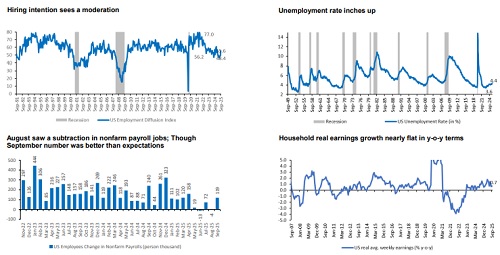

US labour market sees signs of weakness…

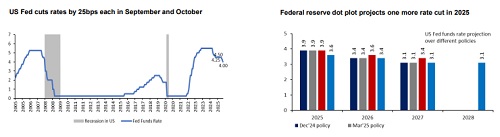

…prompting US Fed to cut interest rates

* The weakening in labour market prompted the Federal Reserve to deliver two consecutive rate cuts.

* The Federal Reserve cut rates by 25bps to 3.75-4.00% on expected lines. One more rate cut is projected in 2025, though Powell said that an additional cut at the December meeting “is not a foregone conclusion”.

* The Fed will end the quantitative tightening starting 1st December 2025.

* The Fed’s second consecutive 25 bp cut was expected, but Powell’s press briefing signalled a pivot toward caution. A divided FOMC and limited data—due to the government shutdown—have raised the threshold for further easing. With growth stabilizing and inflation sticky, insurance cuts appear complete. Market pricing of 1 pp in additional cuts looks aggressive even as the Fed appears willing to tolerate modest inflation overshoots to preserve employment stability. In our view, UST 10Y yields below 4% are unsustainable as 1pp rate cuts are fully priced in and lower UST yields make long duration borrowing (borrowing mix to shift away from T-Bills) more attractive thus putting upward pressure.

Above views are of the author and not of the website kindly read disclaimer