Monthly Market Outlook December 2025 by SBI Mutual Fund

MARKET OUTLOOK

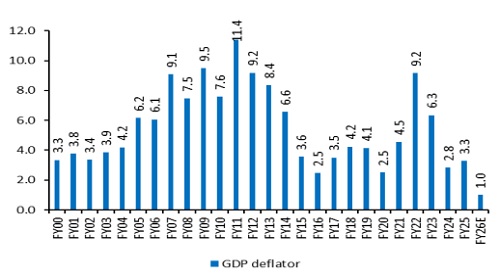

Recent GDP data highlights the contrast between real growth, which remains materially above forecast with Q1 FY26 at 7.8%, Q2 FY26 at 8.2% and H1 nominal growth at below 8.7% y-o-y. While the transmission of policy rates, lower tax rates, potential easing of tariff pressures and regulatory easing should enable growth pick-up, near-term challenges on government revenues, corporate revenues and earnings could be evident going forward. The GDP deflator (a proxy for aggregate inflation in economy) currently at its historical low, also sits at odds with a more realistic measure of economy-wide prices.

EQUITY

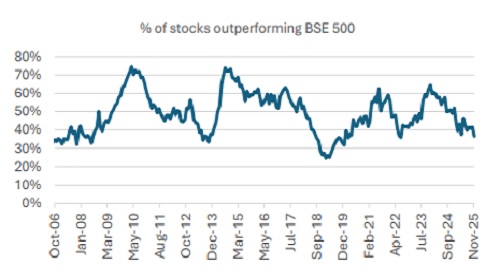

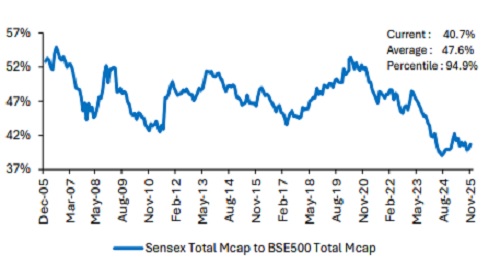

Indian equities did well for the month with the Nifty and the Sensex returning 2% and 2.2% respectively in November. The performance down the market capitalization curve was weaker with Nifty Midcap 150 and Nifty Smallcap 250 returning 1.7% and -3.3% respectively. On a YTD basis, Nifty and Sensex have returned 12.4% and 11.2% respectively as against 6.8% and -5% respectively for Nifty Midcap 150 and Nifty Smallcap 250 indices. Performance beneath the surface suggests a more pronounced deterioration in market breadth. In the BSE 500 universe, two-thirds of the stocks have underperformed the index on rolling 12-month returns. Given that large caps stay cheaper than broader markets on relative valuations, we believe polarization in equity markets may continue to increase.

Market breadth stays weak even as Nifty attempts fresh highs.

Polarization may continue to increase with large caps cheap on relative valuations.

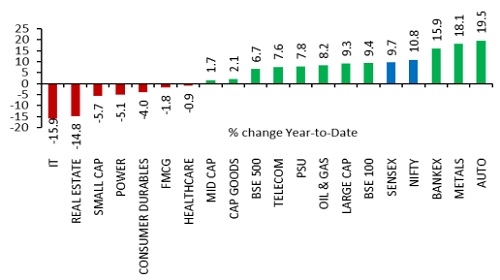

While Nifty has delivered double-digit gains this year, performance across sectors and market capitalizations has been mixed.

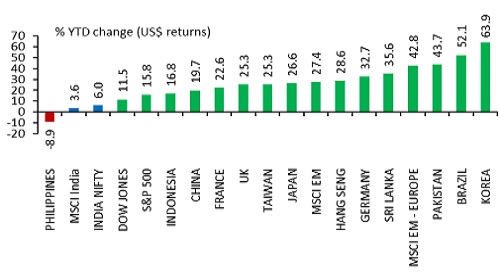

India has stayed an underperformer this year amidst expensive starting valuations and weak earnings.

The recently concluded earnings season pointed to weak but in line corporate performance. Within Nifty companies, even as metals, NBFCs, capital goods, cement and telecom recorded healthy profits growth, weakness in private banks results coupled with a drag from Oil & Gas (ex OMCs), automobile, consumer, and insurance companies put pressure on profitability.

The interesting aspect is that earnings expectations have continued to improve with number of stocks being upgraded nearing the number being downgraded now versus a skew significantly in favour of downgrades over the past few months. Improving consumer sentiment on the back of Income Tax and Goods and Services Tax cuts as well as falling inflation, transmission of policy rate cuts and government’s willingness to push through structural reforms such as the recent labour codes augur well for economic and earnings outlook going forward. On the other hand, however, cyclical headwinds from trade uncertainties and the government’s fiscal capacity constraints pose risks to growth. Overall, earnings and economic growth remain weak, but the worst appears to be behind, and we expect a gradual, directional improvement going forward.

Above views are of the author and not of the website kindly read disclaimer