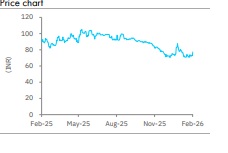

Buy SJVN Ltd for Target Rs.120 by Elara Capitals

SJVN (SJVN IN) revenue increased 61% YoY to INR 10.8bn, led by strong hydro and renewables generation. EBITDA rose 78% YoY to INR 8.4bn. Reported PAT surged 51% YoY to INR 2.2bn. Adjusting for one-time regulatory income of ~INR 1.7bn, adjusted PAT declined 31% YoY to INR 1,025mn. SJVN continues to pursue aggressive expansion with INR 75bn in FY26 capex guidance and ~5.1GW capacity under construction across hydro, solar, and thermal projects. We retain Buy with a lower TP of INR 120.

Revenue increases on buoyant generation: Revenue from operations increased 61% YoY and 5% QoQ to INR 10.8bn. Revenue from hydro generation rose 49% YoY to ~INR 8.4bn. Revenue from renewables generation surged 122% YoY to ~INR 1.2bn. Revenue from operations for Q3FY26 includes ~INR 1.7bn, relating to earlier years, recognized pursuant to receipt of the tariff order for truing-up of tariff during CY19-24 with respect to the Rampur Hydro Power Station. Employee cost declined 15% YoY and 14% QoQ to INR 671mn. EBITDA increased 78% YoY to INR 8.4bn. Depreciation rose 57% YoY to INR 2.16bn. Interest cost was up 7% YoY to ~INR 2.4bn. Other income declined 53% YoY to INR 425mn. Reported PAT increased 51% YoY to INR 2.2bn. Adjusting for one-time regulatory income of ~INR 1.7bn, adjusted PAT fell 31% YoY to INR 1,025mn. Revenue from operations was nil on account of the sale of power through trading for Q3FY26 vs INR 190.8mn in Q3FY25. SJVN’s subsidiaries, namely SJVN Green Energy and SJVN Thermal Power, reported a loss of INR 207.8mn.

Ambitious capex target: SJVN has a capex guidance of INR 75bn in FY26. It has spent INR 36bn in H1FY26. It has a capex target of INR 80bn in FY27.

Projects worth 5GW undergoing construction: Current installed capacity stands at ~3,146.5MW. Buxar unit 1 (660MW) was commissioned in Q3FY26. Once fully operational, the Buxar plant is set to generate ~9,826MU annually. In the solar segment, SJVN has commissioned 1,000MW Bikaner Solar Project. Overall, the company has 5,091MW of capacity currently under construction, including four hydro projects totaling 1,558MW, 14 solar projects aggregating 2,213MW, and one thermal project of 1,320MW

Retain Buy with a lower TP of INR 120: Management has an ambitious plan to achieve 25GW installed capacity in the near term. We remain optimistic about SJVN's long-term growth prospects, supported by robust sectoral fundamentals. The company continues to prioritize expanding installed capacity across a balanced portfolio of hydro, RE and thermal power projects. We retain Buy with a lower TP of INR 120 from INR 131 based on 2.0x (unchanged) FY28E P/B regulated equity. We revise down our TP based on lower-than-expected project commissioning. We reduce our earnings by 10%-9% during FY27-28E, given slower project commissioning

Please refer disclaimer at Report

SEBI Registration number is INH000000933