Hold L&T Technology Services Ltd for the Target Rs. 4,360 By Prabhudas Liladhar Capital Ltd

Strong TCV wins improve visibility, but execution needs to catch up…

Quick Pointers:

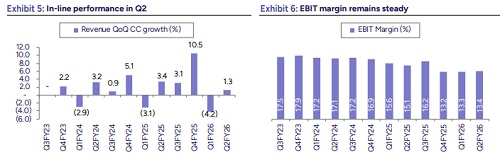

* Inline revenue performance with modest margin improvement in Q2

* Robust deal wins of ~USD 300 mn, 4th straight qtr. of USD 200 mn+ TCV wins

The revenue growth (1.3% QoQ CC) was in line with our estimates. The growth was aided by ramp up of a large deal and continued momentum within Sustainability. The mobility business (ex-Auto) has picked up pace in the offhighway, rails and trucks segments, while Automotive sees incremental pauses and deferrals in decision making. The weakness in the Automotive is fairly balanced against the momentum within Sustainability, validated through securing USD100m deal in Q2 vs USD50m win in Q1. The quarter recorded highest ever deal wins of $300m LDTCV vs USD200m in the previous quarter, outcome of hiring a senior leader to pursue large deals and drive deeper client mining activities. The ask-rate for the rest of the year translates to ~3.0% CQGR to achieve high single-digit CC growth. We believe the continued ramp up of large deal within Sustainability and improving demand visibility within Tech vertical (USD60m win in Q2) should be a tailwind in H2 and beyond. Margins were largely stable despite Automotive weakness, aided by growing mix of high margin business and progressing Intelliswift integration. However, (1) Compensation revision, (2) Large deal ramp ups and (2) SWC pick up in Q4, are the anticipated headwinds in H2, which should keep the margins within a narrow band. We are building in 9.1%/9.0/10.0% CC revenue growth, while keeping our margins at 13.5%/14.7%/15.5% for FY26E/FY27E/FY28E. We are assigning 27x PE to Sep’27 EPS, translating a TP of 4,360. Retain HOLD.

Revenue: LTTS reported Q2 revenue of USD 337 mn, up 1.3% QoQ in CC and 0.6% QoQ in USD in-line of our estimates. Growth was driven by Sustainability (+3% QoQ) and steady performance in Tech, which benefited from Intelliswift integration, while Mobility remained flattish QoQ as the auto sub-segment continued to see program pauses. From a geographical standpoint, US and Europe delivered sequential growth, supported by large-deal ramp-ups, whereas RoW declined due to selective portfolio pruning.

Operating Margin: LTTS reported an EBIT margin of 13.4%, a modest 10 bps QoQ improvement, in line with our estimate of 13.3%. The uptick was driven by a higher mix of margin-accretive Sustainability revenues.

Deal Wins: LTTS secured record TCV of USD 292 mn in Q2 (4th straight quarter of USD 200 mn+ wins) led by two large deals (USD 100 mn in Sustainability and USD 60 mn in Tech). ~80% of the intake was net-new, with deal tenures now extending to 5–7 years. Pipeline remains strong, and management expects at least USD 200 mn TCV again in Q3.

Valuations and outlook: We estimate USD revenue/earnings CAGR of 9%/13.6% over FY25-FY28E. The stock is currently trading at a PE of 28x FY27E earnings, we are assigning P/E of 27x to LTM Sep. 27E earnings with a target price of INR 4,360. We maintain our “HOLD” rating.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271