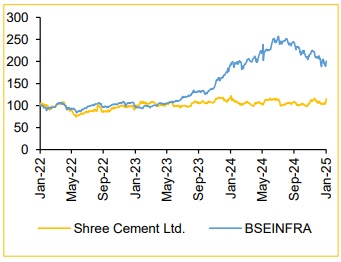

Hold Shree Cement Ltd For the Target Rs.29,760 by Choice Broking Ltd

EBITDA beat, led by cost optimization

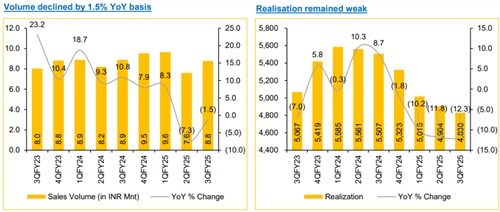

* Q3FY25 revenues at INR42,355 Mn, (vs CEBPL est. INR46,654 Mn), down 13.6% YoY and up 13.6% QoQ. Total volume for Q3 stood at 8.8mnt, (vs CEBPL est. 9.1mnt), down 1.5% YoY and up 15.4% QoQ.

* Net sales realisation for Q3FY25 stood at INR4,830/t, down 12.3% YoY and 1.5% QoQ.

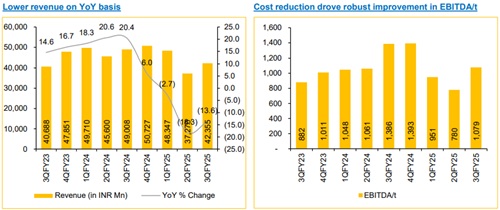

* EBITDA for Q3FY25 was reported at INR9,466 Mn, (vs CEBPL est. INR9,051 Mn) down 23.3% YoY and up 59.8% QoQ. EBITDA/t for Q3 came at INR1,079/t, down 22.1% YoY and up 38.5% QoQ. EBITDA Margins for the quarter was 22.3% (vs CEBPL est. 19.4%), down 282bps YoY and up 645bps QoQ.

* PAT for Q3FY25 reported at INR2,294 Mn, (vs CEBPL est. INR2,413 Mn) down 68.8% YoY and up 146.5% QoQ. EPS for Q3FY25 is INR63.6.

Path to 80 MTPA capacity by FY28 from 52.9 MTPA in FY24 is already 66% done:

SRCM ongoing expansion projects in Jaitaran, Rajasthan (6.0 MTPA), Kodla, Karnataka (3.00 MTPA), Baloda Bazar, Chhattisgarh (3.40 MTPA), and Etah, Uttar Pradesh (3.00 MTPA) are nearing completion and are expected to be commissioned in Q1FY26. Additionally, the company is focused on increasing its share of premium products. We expect SRCM’s cement sales volume to came at 43.9 Mnt by FY27, driven by its capacity expansion plans and emphasis on premium offerings

Focus on cost optimization to drive profitability:

SRCM remains focused on reducing total cost/t. In Q3FY25, total cost stood at INR 3,750/t, marking a decline of 9.0% YoY and 9.1% QoQ. This reduction was primarily driven by lower fuel prices and the company’s consistent efforts to expand its green power capacity. As of Q3FY25, green power capacity reached 522 MW, reflecting a 9% increase from 480 MW at the beginning of FY24-25. We anticipate further cost reductions, with an expected improvement in EBITDA/t by ~INR 300/t by FY28. Supported by these cost-saving initiatives, we project the Company's EBITDA/t to came at INR1,369/t by FY27

View & Valuation:

We revise our FY26/27 EPS estimates by 1.2%/4.4% and maintaining our rating to ‘HOLD’ with a revised TP of INR29,760, valuing it at 18x (unchanged) on FY27 EV/EBITDA. We anticipate cement demand to grow, driven by an expected rise in rural consumption supported by improved farm cash flows, sustained strong demand for urban housing, and increased government spending on infrastructure projects. These factors create a favorable outlook for the cement industry in the coming years.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131