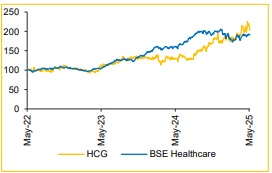

Reduce Healthcare Global Enterprises Ltd For Target Rs. 575 - Choice Broking Ltd

Growth Plans in Place, But Profitability to Remain Subdued Near-Term

Q4 performance showed healthy revenue growth; however, higher finance costs weighed on profitability, resulting in a YoY decline in PAT. While HCG has outlined a strong expansion roadmap—with ~900 beds expected to be operationalized over the next three years—we believe this will keep EBITDA margin growth muted. Management has guided for margins to remain below 20% during this period. Additionally, ARPOB is expected to grow in line with inflation, with occupancy likely to remain flat or decline slightly. Though a full ramp-up of the new facilities and improved execution following KKR’s strategic stake are likely to support longer-term growth, we expect near-term performance to remain constrained as the company focuses on scaling operations.

In light of these factors, we revise our earnings estimates downward by 25.6%/11.6% for FY26E/FY27E, respectively. We continue to value the stock at an unchanged EV/EBITDA multiple of 17x on FY27E estimates, applying a 20% discount to peers due to its relatively lower ARPOB and EBITDA margins. Accordingly, we revise our target price to INR 575 (earlier: INR 621) and downgrade our rating to REDUCE.

Revenue & EBITDA Miss; PAT Exceeds Street Expectations with Increased Other Income

* Revenue came at INR 5.9 Bn (vs. consensus est. of INR 6.0 Bn), up 18.3% YoY and 4.8% QoQ.

* ARPOB stood at INR 44,236, up 3.5% YoY and flat QoQ, while occupancy improved to 67% vs. 62% in Q3 and 64% in Q4FY24.

* EBITDA came at INR 1.06 Bn (slightly below consensus), up 14.9% YoY and 19.6% QoQ. EBITDA margin came at 18.1% (in line with consensus), contracted 54 bps YoY and expanded 224 bps QoQ.

* PAT came at INR 0.07 Bn (vs. consensus est. of INR 0.05 Bn), down 65.5% YoY and up 5.4% QoQ.

HCG’s Long Term Growth to Be Driven by ~900 Bed Addition

HCG plans to add approximately 900 beds over the next three years through a mix of organic expansion, brownfield projects, and strategic acquisitions. This will enhance its operational capacity from 1,493 beds in FY25 to 2,243 beds by FY27E, with a focus on high-ARPOB, high-demand markets such as Bengaluru and Ahmedabad. During FY25, the company acquired MGM Hospital in Vizag, which is expected to stabilize operationally over the next 2–3 quarters. Additionally, HCG commissioned its flagship 189-bed facility in Ahmedabad, which is expected to meaningfully contribute to revenue from FY26 onward. We believe full-scale rampup of these facilities will significantly support the company’s growth trajectory in the long run.

Limited EBITDA Upside in Near Term Due to New Facility Ramp-Up

The company’s EBITDA margin remained flat in FY25 at 17.4%. Looking ahead, we expect growth to remain subdued due to increased operational costs associated with new facilities. Management has guided for ARPOB growth of ~7%, largely inflationlinked, while occupancy levels are expected to remain stable. As a result, revenue may see a temporary dip in FY26E before recovering in FY27E as the new facilities ramp up to full scale. We expect a marginal improvement in EBITDA; however, meaningful growth is unlikely over the next 2–3 years.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131