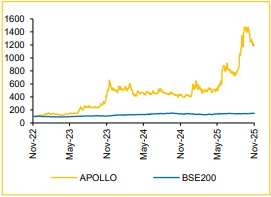

Add Apollo Micro Systems Ltd For Target Rs. 300 By Choice Broking Ltd

Margin Soars; Bright Path Ahead

We believe APOLLO is entering a decisive growth phase, evolving from a subsystem supplier to a full-fledged weapons manufacturer. Q2FY26 performance reflected strong execution, record profitability and rising operating leverage – validating its transition to higher-value defence programs. We expect the commissioning of Unit-III in the near future, resulting in eight-fold capacity expansion. In addition, integration of IDL Explosives would materially enhance APOLLO’s manufacturing depth and self-reliance across critical value chains. With 25–30% of revenues already derived from production-linked projects and the mix shifting towards 40–45% by FY27E, we see a strong foundation for 45–50% revenue CAGR over FY26–27E. This is driven by large program conversions and steady costefficiency.

We view APOLLO’s dual growth engines – organic innovation through indigenous DRDO-linked programs and inorganic expansion via IDL – as structural catalysts for long-term scalability. Its participation across major platforms, such as MIGM, QRSAM, ALWT, Varunastra and BrahMos reaffirms its technological relevance in India’s defence ecosystem. We see growing export traction from the UK, Saudi Arabia and Europe comes as an additional lever for expansion. The upcoming in-house testing infrastructure and improving working-capital management should help sustain healthy 26– 28% EBITDA margin in future. In our view, APOLLO is rapidly transforming into a vertically integrated, system-level defence powerhouse.

All-Round Beat — Strong Execution Drives Margin Surprise

* Revenue for Q2FY26 up 40.2% YoY and up 68.6% QoQ at INR 2,253 Mn (vs CIE est. INR 2,036 Mn)

* EBIDTA for Q2FY26 up 79.9% YoY and up 44.6% QoQ at INR 592 Mn (vs CIE est. INR 458 Mn). EBITDA margin stood at 26.3%, improved by 581bps YoY (vs CIE est. of 22.5%)

* PAT for Q2FY26 up 90.9% YoY and up 69.8% QoQ at INR 300 Mn (vs CIE est. INR 222 Mn). PAT margin improved by 354bps YoY, reaching 13.3% (vs CIE est. 10.9%)

View & valuation: We remain positive on APOLLO’s strategic transformation from a component supplier to a full-fledged system integrator. We forecast Revenue and EPS to expand at a robust CAGR of 50.0% and 58.8% over FY25–28E. Considering the company’s solid growth outlook, we have raised our target multiple to 50x (from 45x). However, following the recent sharp rally in the stock, we downgrade our rating to ADD (from BUY). Based on our revised estimates, we arrive at a target price of INR 300, valuing the stock at the avg of FY27–28E EPS, implying a PEG ratio of 1.54.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131