Sell Tata Elxsi Ltd for Target Rs 4,520 by Elara Capitals

Strong Q3; valuation appears full

Tata Elxsi (TELX IN) reported better-than-expected Q3, on revenue and margin fronts. Revenue growth was driven by the transportation vertical, which accelerated given some delayed deals materializing in Q3 (spill-over from Q2). TELX is aiming for double-digit growth in transportation and healthcare in FY27. We believe that double-digit growth in transportation is achievable, considering some of the recent deal wins as well as uptick in growth for its top client. However, double-digit growth in healthcare looks challenging, in our view, considering its continued weak performance. We maintain SELL with a higher TP of INR 4,520, on 30x FY28E P/E.

Sequential revenue growth led by deal ramp-ups: TELX reported revenue growth of 1.7% QoQ in USD (+3.2 QoQ in CC), while revenue declined 3.8% YoY in USD (-5.5% in YoY CC) in Q3. In INR terms, revenue was up 3.9% QoQ, supported by currency depreciation. Geography-wise growth was led by recovery in Europe, up 5.8% YoY after three quarters of decline. Americas continued with uptrend, growing 5.1% in Q3FY26. RoW was up 1.5% YoY, while India market was a drag on growth, declining 12.6% YoY on INR basis

Vertical-wise and in CC YoY, Software Development & Services (97.2% of revenue) declined 6.0%, while System Integration & Support (2.8% of revenue) reported a growth of 14.8% in YoY CC basis. The SDS vertical was up 3.5% QoQ CC, led by sequential recovery in transportation (+7.2% QoQ CC). Within SDS, Transportation, Media and Communications, Healthcare & Life Sciences continued to report a YoY CC decline in the range of 4.2-12.2%.

EBITDA margin was up 220bps QoQ to 23.3%, primarily led by 200bps benefit from operating leverage and utilization gains, 80-85bps from cost discipline, ~35bps from favorable currency, though partially offset by 110bps impact from wage hikes for junior-to-mid staff. At the PBT level, margins were hit by labor code-related one-off impact of INR 957mn. TELX indicated wage hike headwind for Q4 to be lower than in Q3 and expects further scope to improve utilization from the current ~75% to 80-85% in the long run, helping margins revert to prior peak by the exit of FY27. Labor code impact expected to be immaterial (15-20bps) in Q4.

Maintain SELL with a higher TP of INR 4,520: We raise revenue/earnings estimates for FY26E28E by 3-4% to reflect strong Q3 and some recovery in FY27E/28E. We build in mid-single digit growth in FY27E for healthcare (against guidance of double-digit growth) as we await growth recovery in subsequent quarters. FY27E earnings may be higher optically due to a low FY26 base and labor code, but we build in steady-state 17% earnings CAGR in FY26E-28E.

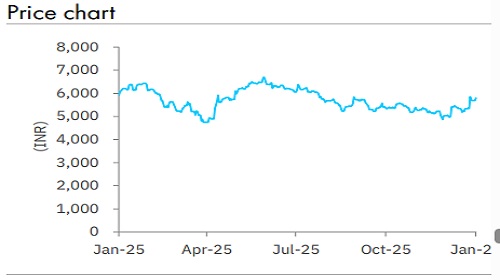

We maintain Sell with a higher TP of INR 4,520 (from INR 4,390), on 30x FY28E P/E. Planned reduction in products and investments by auto OEMs in the medium term will have a direct bearing on TELX’s transportation revenue and revenue growth may unlikely reach prior levels. Due to continued weakness in other two verticals, earnings may be depressed versus prior numbers. After the recent run up, the stock is trading at 45x/38x on FY27E/FY28E and valuations appear full.

Please refer disclaimer at Report

SEBI Registration number is INH000000933