Buy HealthCare Global Enterprises Ltd for the Target Rs.850 by PL Capital

Quick Pointers:

* Reiterated revenue growth guidance of 15%+, driven by ~10% volume growth and ~5% ARPP growth.

* Board meeting on 17 Feb to consider the fund raise through rights issue

HealthCare Global Enterprises’ (HCG) Q3 consolidated adjusted EBITDA for ESOP and one off cost grew by 20% YoY. Mgmt guided higher EBITDA growth than historical growth in coming years. HCG’s asset-light approach with a focus on partnerships has made its business model more capital efficient and scalable, in our view. We believe the recent strategic investment by KKR will bring in more operational and financial efficiency. Currently, HCG enjoys ~14% PRE IND-AS margin, which is lower than its peers. We expect KKR to drive growth through bed expansion largely brownfield, better payor mix, focused marketing initiatives and scale up of margins. We expect ~23% EBITDA CAGR over FY26-28E. At CMP, the stock trades at attractive valuations of 16x EV/EBITDA adjusted for rentals and minority. Recommend ‘BUY’ rating with a TP of Rs850/share valuing at 22x on FY28E EV/EBITDA.

In line EBITDA: HCG reported post-IND AS EBITDA of Rs1.1bn, up 24% YoY. Adjusted for ESOP and one time cost, EBITDA came in at Rs1.1mn (up 20% YoY) with OPM of 17.3%; improved by 100bps YoY. Employee cost and consultancy charges increased by 6% and ~14% YoY. While Other expenses increased by 6% YoY. Adjusted PAT stood at Rs 32mn. There was new labor code impact of Rs 127mn in Q3.

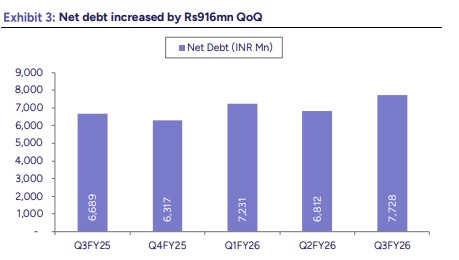

Healthy ARPP and Volumes: Cluster wise, West, East and South grew 17% YoY, 12% YoY and 9% YoY, respectively. While international (Kenya) and Milann grew by 42% YoY and 11% YoY in Q3. ARPP ex of fertility improved by 5% YoY for Q3 and 3% for 9M. Overall IP volumes grew by 8% YoY for Q3 and 13% for 9M. Net debt increased by Rs916mn QoQ to Rs7.7bn.

Above views are of the author and not of the website kindly read disclaimer