Accumulate RBL Bank Ltd for Target Rs 345 by Elara Capitals

Mixed bag; upside to unfold gradually

RBL Bank ( RBL IN) reported a mixed Q3FY26 performance . While core PPoP was steady ,

elevated slippages and credit cost were a miss. The key highlights were : 1) stronger NII , up

7% QoQ, with a 12bp QoQ rise in NIM (drawing support from better funding cost ) and steady

loan growth, and 2) softer asset quality outcomes with elevated slippages , driven primarily

by credit cards. RBL is emerging from the prolonged phase of consolidation & balance sheet

reorientation and seems at inflexion point, with early signs of stability across key operating

metrics. While the transition (pending few approvals) would play well, we see several

moving variables at play , and the journey will be more gradual. We retain Accumulate with

a higher TP of INR 345 as we roll forward to December 2027E .

Asset-side transition underway; growth shaping up well: RBL has been reorienting its

balance sheet toward more durable, risk -calibrated growth with a focus on retail and MSME

lending. Q3 saw similar trends with stronger growth in MSME, business banking , and mid -

corporate segment being the key driver s. This along with better NIM , up 12bp QoQ, was led

by uptick of 4 bp CRR release, balance sheet efficiency, improvement in short -term

investments , fed into 7% QoQ NII growth. Deposit growth at 2.6% QoQ and 12% YoY was steady ,

driven by term deposits while traction on CASA base remains softer. On the liability side,

while there is steady reweighting, the road ahead is long as RBL lags sectoral averages (more

progress is needed to close this structural gap).

Cost ratios – a lot needs to be done: Q3 saw 2.3% Q oQ opex gr owth with 3.6% QoQ employee

cost growth as it had one -time impact of Labour Law changes of INR 286mn . Overall core

profitability growth seems to be gaining momentum with Q3 core PPoP growth pegged at 13%

plus , but sustainability is the key. Our analysis on cost ratios for RBK does leave a few open

ends , which warrant to be monitor ed. We see a durable reduction in cost structure to be key

to core PPoP growth , which , in turn , would drive re rating.

Credit cost volatility persists: Slippages stood at ~INR 9bn (~ 3.6% of lagged loans , higher than

estimates) , led by higher credit card slippages and rise in secured book as well while MFI

slippages continue to trend down. The bank expects two quarters of elevated slippage s in

credit cards, which w ould lower the pace of improvement. PCR has trended down to 71%

levels v s >85% in FY25 , which could render variability in credit cost outcome . W hile RBL has

tightened internal controls and reduced concentration, we believe higher exposure to

unsecured segments will continue to be volatil e, with outcomes more contingent on macro

cycles.

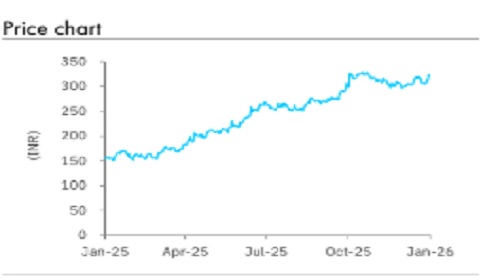

Retain Accumulate with a higher TP of INR 345: While strategic repair is underway, we see

current valuation of 1.0x FY28 E P/BV after 21% outperformance in the past six months vs the

index at ~3 %, capture the recent progress and residual risk fairly. We await greater

consistency in earnings and return ratios before turning more constructive. We retain

Accumulate with a higher TP of INR 345 from INR 315 based on 1.0x (unchanged) P/B V as we

roll forward to December 2027E .

Please refer disclaimer at Report

SEBI Registration number is INH000000933