Buy Gujarat Fluorochemicals Ltd for Target Rs. 4,583 by Elara Capitals

Strong demand growth drivers

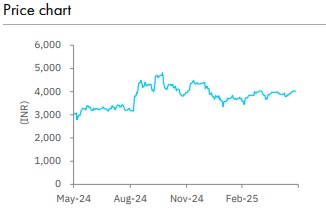

The stock price of Gujarat Fluorochemicals (FLUOROCH IN) fell 1% in the past three months as against the benchmark Nifty Midcap Index running up 16% because of the temporary drop in prices of PVDF (polyvinylidene fluoride, a major new fluoropolymer) and bulk chemicals (caustic soda and chloromethane), which, we believe, contribute +30% to total revenue. Going forward, we are bullish on fluoropolymers demand, as indicated by global players (Arkema, Kureha, Solvay, AGC) in their strong revenue growth guidance for the fluoropolymer segment (7% growth guidance in CY25 versus 3% dip in CY24), as well as robust 22% median EBITDA margin guidance in CY25 versus 17% in CY24.

Globally, demand growth driver for fluoropolymers are: 1) resilience in building energy efficiency/transition, electronics & sporting goods and 2) anticipated rebound in automotiverelated PVDF demand. We maintain our TP at INR 4,583 and reiterate BUY on FLOUOROCH

Q4 EBITDA up 29% YoY led by growing demand for fluoropolymers: FLUOROCH reported an EBITDA of INR 3.1bn and a PAT of INR 1.9bn, versus our expectations of INR 3.1bn and INR 1.4bn, respectively. Q4 EBITDA was up 29%/4% YoY/QoQ and PAT up 89%/52% YoY/QoQ. YoY earnings growth was driven by a recovery in fluorochemicals and fluoropolymers (respective revenue growth at 8% and 11% YoY). FLUOROCH reported lower tax expenses due to a one-time reversal of deferred tax liability of INR 290mn.

Volume-led earnings growth amid stable prices: Fluoropolymers growth was driven by volume growth in new fluoropolymers even as overall fluoropolymer prices (including PTFE – Polytetrafluoroethylene) were steady QoQ. As per the management, demand from auto, semiconductors, electric vehicles (EV), energy storage systems and exit of legacy fluoropolymer players will drive demand for high-grade fluoropolymers. FLUOROCH is bullish on growth in fluoropolymer demand based on positive feedback from the customers.

Reiterate BUY with TP unchanged at INR 4,583: We reduce FY26E and FY27E revenue estimates by 9% and 6% on lower raw material prices, but we maintain our FY26E and FY27E EPS estimates. We introduce FY28E EPS at INR 155, ascribing 41% YoY growth, led by benefit from the commissioning of R32 plant and integrated manufacturing facility of battery material as well as strong demand growth forecast for the existing fluoropolymers plant.

We reiterate Buy with an unchanged TP of INR 4,583. We expect robust growth in demand for fluoropolymers based on global commentaries, due to increased demand from new-age industries, such as EVs, electrolyzers, semiconductors, and solar panels. We value FLUOROCH on DCF, assuming 5.0% (unchanged) terminal growth and 9.3% (unchanged) cost of capital, with an EBITDA CAGR of 35% (from 30%) in FY25-29E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933