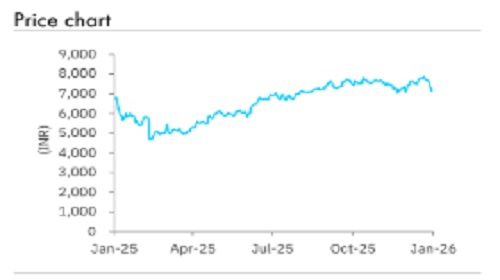

Accumulate Polycab India Ltd for Target Rs 8,180 by Elara Capitals

Copper surge drives volume but hits margin

Polycab India (POLYCAB IN) saw its highest-ever sales growth, up 46% YoY, led by cables &

wires (C&W outperformance due to the surge in copper prices and strong volume growth).

Domestic C&W saw volume growth of 40% YoY, led by wires that outgrew cables. Margin,

however, took a hit as POLYCAB passed on 75-80% of commodity price rise along with lower

contribution from exports. We reiterate Accumulate with a higher TP of INR 8,180 on 33x

December FY27E P/E. We remain positive on robust domestic demand, led by capex, along with

surging copper prices, resulting in average selling price (ASP) rise, strong lead over the No 2

C&W firm in top line, huge capex plan to enable growth, and Fast Moving Electric Goods (FMEG)

profitability.

C&W outperformance led by volume growth, commodity price rise: POLYCAB saw 56% YoY

growth in C&W, led by copper price surge, up 21% QoQ and 50% YoY, and 40% YoY volume

growth in domestic C&W. The company saw wires outpace cables during the quarter, due to

stocking by distributors ahead of copper price rise. Volume growth was similar for C&W;

however, in value terms, due to higher copper content, wires grew by 70% YoY while cables

grew 50% YoY. POLYCAB expects growth momentum to continue in Q4 as well. The company

has to date passed on a mere 75-80% of commodity price rise to the customer, with the

balance expected to be passed on in Q4. The international business saw 5% growth, due to

high base and impact of US tariffs. Institutional sales outpaced distributor-driven sales

during the quarter, with mix improving 100bp for institutional sales to 11% of overall sales

and distributors contributing 89%.

FMEG retains profitability, led by solar: The FMEG segment continues its profitable run after

two years of losses, and amid a subdued quarter for fans, due to higher contribution from the

solar category, which has become the largest segment in FMEG. Solar inverter continues its

strong growth trajectory, spiking 2x YoY, with a high single-digit margin profile. Fans

growth was flat for the industry, and POLYCAB, due to off-season, while the other categories

growth were in line with the industry. It expects a price hike of 2-4% for fans to be taken in

the next quarter, due to change in BEE norms.

Margin contracts due to adverse mix, lag in passing on price rise: EBITDA margin contracted

110bp YoY to 12.7%, due to unfavorable product mix as exports reduced and institutional sales

increased, lag in passing on complete price rise to the customer, and one-time increase in

gratuity provision of INR 219mn. EBIT margin for cables fell 130bp YoY to 12.2% while FMEG

margin improved from -3% in base quarter to 2.8%, and EPC margin fell 440bp YoY to 6.7%.

Reiterate Accumulate with a higher TP of INR 8,180: We raise our FY27E EPS by 2% due to

higher value sales on copper price surge but lower our FY28E EPS by 3% on margin impact

by adverse mix, including lower exports. We raise our TP to INR 8,180 from INR 7,970 on 33x

(unchanged) December FY27E P/E, as we roll forward by a quarter. We reiterate Accumulate,

given its industry-leading margin, strong lead over the No 2 C&W firm in top line, huge capex

plan to enable growth, and surging metal prices, resulting in ASP rise. We expect an earnings

CAGR of 23% during FY25-28E with an average ROE and ROCE of 24% & 25% during FY26-28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933