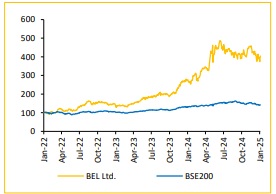

Buy Bharat Electronics Ltd For Target Rs. 420 - Choice Broking Ltd

Demonstrated Capability and Strong Growth Visibility

BEL’s platforms demonstrated exceptional performance during Operation Sindoor, with extensive deployment in the India-Pakistan conflict. This success has reinforced the Indian armed forces' confidence in BEL’s capabilities while showcasing its ability to deliver complex, mission-critical; systems an expertise now gaining recognition in international markets. With the Ministry of defense announcing an emergency procurement program worth INR 400-500Bn, BEL is well-positioned to emerge as a key beneficiary. The company’s robust order book of over INR 710Bn, combined with high-visibility projects such as the INR 300+ Bn QRSAM, INR 270Bn in assured orders in FY26E, and strategic programs like NGC subsystems, LCA upgrades, and radar and EW systems, provides strong revenue growth momentum and cements BEL’s leadership in the sector.

We expect in response to rising geopolitical tensions, BEL is accelerating project execution for replenishment order, supported by a strong MSME vendor ecosystem contributing ~35% to project execution. This is expected to drive faster revenue recognition, while its in-house designed, supports healthy margin expansion. Furthermore, BEL is tapping into growing export opportunities, particularly in Europe, and is actively investing in emerging tech such as drone warfare and AI-integrated solutions. These initiatives enhance BEL’s future earnings visibility and positioned the company for sustained long-term growth.

Big-beat on market expectations

* Revenue for Q4FY25 up by 6.8% YoY & up by 58.6% QoQ at INR 91.5Bn (vs consensus est. INR 88.9Bn).

* EBIDTA for Q4FY25 up by 23.1% YoY and up 68.7% QoQ at INR 28.2Bn (vs consensus est. INR 22.2Bn). The EBITDA Margin stood at 30.8%, improved by 407bps YoY (vs consensus est. of 24.9%).

* PAT up by 18.8% YoY and up 63.0% QoQ at INR 21.2Bn (vs consensus est. INR 17.5Bn). PATM improved by 233bps YoY, reaching 23.2%.

Robust Order Book and Strong Project Pipeline:

BEL’s current order book stands at INR 716.5Bn (3.0x FY25 Sales). We believe the companies order inflow will gain traction due to emergency procurement and speeding up the existing projects. supported by marquee upcoming projects such as the INR 300+Bn QRSAM order and the INR 400Bn Project Kusha. The company’s diversified pipeline, including NGC subsystems, additional LCA orders, and critical defense systems like LRSAM and radar solutions, positions it well for sustained revenue growth and market leadership.

View & Valuation:

We maintain a positive outlook on BHE given its strong longterm growth prospects, supported by a robust order backlog and pipeline, driven by the government's emphasis on defense indigenization. The company's strong financials and return ratios, along with consistent margin improvement, reinforce our confidence in its financial performance. We revise our estimates of FY26/27 EPS estimates by 7.3%/7.4% and maintain our rating to ‘BUY’ with a revised TP of INR 420 (earlier the TP was at INR 370), valuating it at 40x of FY27E EPS.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131