Buy MAS Financial Services Limited for the Target Rs.415 by Choice Institutional Equity

Sustained AUM Growth led by Presence across High-growth Portfolios and Branch Expansion

MASFIN, in its operational history of more than three decades, maintains a strong pan-India presence. Its distribution network comprises a dense network of 208 branches (mainly located in Western India) and partnerships with 215 NBFCs. Led by its niche lending model built around co-lending and NBFC partnerships, the company has scaled up its standalone AUM at a 22.5% CAGR over FY21–25 to INR 121.0 Bn. The growth was primarily driven by Personal Loans (scaled up from NIL as of FY21 to ~INR 10.4 Bn as of FY25), Commercial Vehicle Loans (+48.2% CAGR), 2-Wheeler Loans (+24.5% CAGR) and SME Loans (+24.5% CAGR). We forecast MASFIN to further ramp up the AUM at 23.4% CAGR over FY26E– FY28E, driven by its focussed execution across Wheels Financing (CV and 2W) and SME segments. Higher loan growth will be aided by strong demand tailwind across the end-user sectors, faster loan-to-sanction cycle and expansion in the number of branches (aims to add ~200–250 in the next decade), leading to the formation of a dense distribution network

Superior Asset Quality led by In-house Developed Tech and Credit Appraisal System

MASFIN has built a proprietary, technology-led underwriting platform which enables fully digital, rule-based credit origination at scale, across its branch network and NBFC partner ecosystem. Historically, portfolio expansion was driven largely by localised credit teams, yet the company delivered strong AUM growth of over 20% in the last decade, while maintaining net Stage 3 assets at ~1.7% of AUM as of Q3FY26. With the BRE (Bank Rules Engine)- enabled Loan Origination System (LOS) now institutionalised, MASFIN is positioned to scale up and geographically diversify growth. The platform enables consistent credit decisioning, centralised risk oversight and rapid product replication across geographies. We expect the future long-term growth to be broad-based while maintaining a tight control over the asset quality and riskadjusted returns

Improvement in Profitability led by Change in AUM Mix (%) and Higher Leverage

MASFIN’s profitability is expected to improve in the medium term, driven by asset mix optimisation, higher direct originations and prudent leverage. Portfolio yields are projected to increase, from ~12.4% in FY26E to ~12.8% by FY28E, led by higher exposure to high-yield loans and increase in direct retail business. Direct retail assets is anticipated to increase, from ~66% in FY25 and to ~70–75% by FY28E, supporting higher NIMs. Improved underwriting policies driven by implementation of new LOS and portfolio seasoning is projected to drive lower credit cost (on average Loans) from ~1.7% in FY26E to ~1.4% in FY28E. We project the Average RoA to remain sustainable at ~3.0% (over FY26E–FY28E), while RoE would improve, from 13.2% in FY26E to 16.0% by FY28E, driven by higher leverage (from ~4.5x in FY25 to ~5.4x by FY28E)

Valuation and View

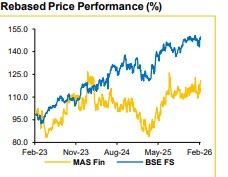

We initiate coverage with a “BUY” rating on the stock. We value the standalone lending business at 2.0x FY28E ABV (based on peer-group benchmarking for financial and operational metrics), implying a target price of INR 415.0 per share, with an upside potential of 25.5%. As a sanity check, we cross-validated our P/ABV derived TP with residual income approach TP of INR 410.

Key Risks

Potentially slower-than-expected loan growth, inability to expand branch and NBFC partner network and likely higher delinquencies across MEL, SME and Wheels Financing segments.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131