Buy Tata Consumer Products Ltd for the Target Rs. 1,300 by Motilal Oswal Financial Services Ltd

Stronger harvest & lower prices of tea to aid profitability in 2H

In FY25, India’s tea production declined 5% YoY but rebounded in the current season (Jan– Jul’25) with 14% growth, led by Assam and West Bengal. This stabilized prices after a peak in Jun’25. The Indian tea business remained resilient, with pricing actions partly offsetting cost pressures; margins contracted in 1QFY26 but are expected to improve from 2Q as production improves and prices stabilize. Alongside, the company is expanding its health & wellness portfolio, premiumizing its tea product portfolio in the domestic market, and maintaining ecommerce leadership. In this note, we have analyzed tea prices and production trends and their impact on Tata Consumer Products (TATACONS). Here are the key insights:

Robust YTD growth in tea output led by Assam and West Bengal

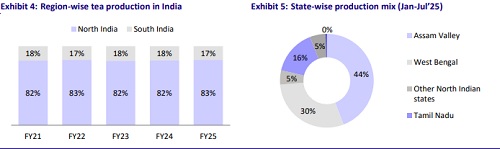

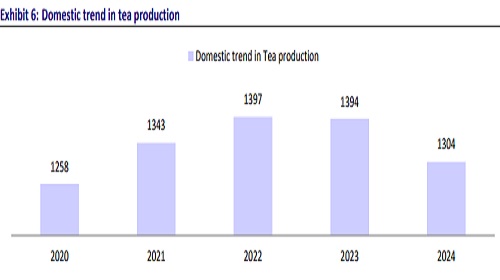

* In the FY25 tea season, domestic production dipped 5% YoY to 1,315m kg. This was led by ~8 and ~4% dip in production in South and North India, respectively.

* Tea production for the current season YTD (Jan-Jul’25) has been up 14% YoY to 641.4m kg, fueled by better production across regions. Production in South and North India has risen 11% and 14%, respectively. Production in North India grew due to a 22%/11% growth in West Bengal/Assam (which contributed 30%/44% of India’s total tea production). As Assam and West Bengal constituted ~77% of total tea production in India in the CY24 season, an improved production in these regions led to stabilization of tea prices across India.

* All India tea production during the first flush (Feb-Jun, contributed 31% to the whole tea cycle volume in CY24 and generally has the best quality) rose 14% YoY, fueled by a strong 50%/25%/40% YoY production growth in Feb’25/ Apr’25/May’25. However, tea production dipped 9% YoY in Jun’25 due to adverse weather conditions and pest attacks.

* Heavy rainfall in Jun’25 flooded tea gardens in Assam, making plucking of tea leaves difficult for workers. This resulted in lower production in Assam, down 11% YoY to 64.2m kg in Jun’25. Heavy rains in West Bengal also hurt tea production (down 2% YoY) in Jun’25.

* July is usually the start of the second flush (Jul-Sep, contributed 39% to the total volume in CY24 and has the second-best quality). In Jul’25, all India tea production increased 14% YoY to 171.72m kg, as the decline in South India (down 11% YoY) was offset by strong production growth in Assam and West Bengal, up 25% and 9% YoY, respectively.

* All India tea production in CY25 is anticipated to be higher YoY, with the impact of the floods wearing off and no other extreme event expected.

Tea prices ease after peaking; margin expansion on the horizon

* TATACONS’ tea business displayed resilience amid inflationary pressures. The challenging demand environment, with tea prices increasing ~30% YoY in the last procuring season, led to consolidated EBITDA margins contaracting by ~260bp in 1QFY26, of which ~160bp was attributable to the inacrese in tea prices with the company only being able to pass on ~70% of the cost increase to its customers.

* Average tea prices peaked in Jun’25 (albeit lower when compared to CY24), led by 1) strong demand from Russia, Iran, Iraq, and the UAE, 2) increased domestic purchases from major players such as TATACONS and HUL, and 3) lower supply.

* However, tea prices declined 2.1%/5.4% MoM and ~8%/14% YoY in Jul’25/ Aug’25, respectively, to reach average prices of INR203 per kg / INR192 per kg.

* Going forward, with a likely improvement in tea production, prices are expected to either remain stable or trend down from the current levels, supporting margin expansion in the tea segment.

* We expect margin to normalize post-2QFY26, supported by strong production and the stabilization of tea prices. Management targets a 33-35% gross margins in the tea segment (compared to mid-20% in 1QFY26 in the tea segment, while standalone gross margins contarcted 380bp/610bp on a YoY basis to 32.7%/33.2% 1QFY26/FY25).

Strategic portfolio expansion: Health, wellness, and premiumization

* To cater to the rising health & wellness trend, TATACONS has further reinforced its beverage portfolio with the launch of Tata Tea Gold Vita Care (vitaminenriched enriched black tea), Immuno Chai (to help support the immune system) and instant mix Tetley Green Tea in low unit price packs to democratize green tea

* With the acquisition of organic India, the company’s portfolio now encompasses organic and herbal teas, food staples, and herbal supplements, complemented by Tetley’s Kombucha range, which caters to health-conscious and trend-savvy consumers.

* TATACONS is strengthening its international portfolio through the introduction of premium offerings such as Tetley black teas inspired by Britain’s classic baked treats, a Ceylon and Kenyan tea blend under its super-premium brand teapigs, and Tetley Chai Latte, a convenient instant spiced tea.

* This broadened, health-forward portfolio is expected to boost ’s growth by expanding addressable markets, premiumizing the mix, and strengthening pricing power and margins across India and key international geographies.

* Tata Tea Gold has emerged as the largest brand in the e-commerce channel, further underscoring the ongoing shift towards premiumization and the growing relevance of e-commerce as a future growth driver.

Valuation and view

* With the moderation of tea prices and strong tea crop growth this season, we expect TATACONS’s margins to recover in the Indian beverage business from 2HFY26. We also anticipate strong traction in its growth businesses.

* We expect the company to sustain its growth momentum, aided by the mid-tolong-term triggers such as 1) strengthening and accelerating its core business, 2) exploring new opportunities, 3) expanding its product portfolio and innovation, and 4) enhancing its focus on premiumization and health and wellness products.

* We expect TATACONS to clock a revenue/EBITDA/PAT CAGR of 10%/12%/13% during FY25-27. We reiterate our BUY rating with an SoTP-based TP of INR1,300.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)