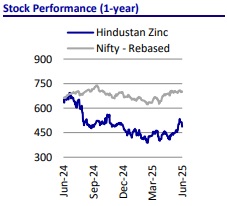

Neutral Hindustan Zinc Ltd for the Target Rs. 480 by Motilal Oswal Financial Services Ltd

Announces expansion plans; step toward 2x capacity growth

HZL’s Board has approved a growth capex of ~INR120b (funded through internal accruals and debt) to expand the zinc smelting capacity by 250ktpa at Debari, along with a mines capacity expansion of 330ktpa (Rajpura Dariba - 2.5ktpa and Zawar - 0.8ktpa).

Key takeaways from the investor call held by the company:

* The project is expected to be completed in the next 36 months, with capex spread across FY26-28 (guidance: INR35b - FY26, INR50b - FY27, and the rest in FY28).

* Of the INR120b capex plan, ~INR62.5b will be allocated to expanding zinc smelting capacity at Debari (at USD2,500/t), which includes INR10-12b for associated facilities such as the leaching & purification plant, cell house, and roaster. The remaining capex will be incurred on mine expansion.

* The Debari smelter expansion project will have its own fumer facility, which will produce 30tpa of silver.

* Following the completion of phase-I, the refined metal capacity will reach 1.379mtpa (1.169/0.21mtpa - Zinc/Lead, respectively), with refined silver capacity increasing by 30tpa to 830tpa.

* The existing metal capacity of ~1.129mtpa operated at a utilization level of ~93% in FY25. The current phase-I expansion is expected to add ~22% to this capacity.

* Phase-II aims to double the refined metal capacity to 2mtpa (1.6/0.4mtpa - Zinc/Lead, respectively) and silver capacity to 1.5ktpa.

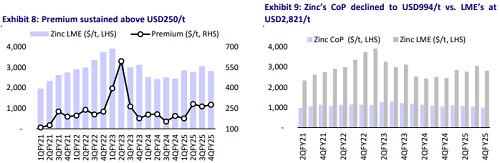

* Management has guided for Cost of Production (CoP) to remain competitive at USD1,025-1,050/t.

* The company expects revenue to rise from INR341b in FY25 to INR400-420b with the ramp-up of phase-I expansion, and further to INR620-650b upon the completion of the expansion plan.

* EBITDA is expected to increase from INR174b in FY25 to INR210-220b post the phase-I expansion, and further to INR340-360b after the phase-II expansion, considering the LME prices and exchange rates remain constant.

Valuation and view

* The expansion plans are in line with the company’s long-term target to double its capacity. It continues to focus on improving production with tight cost control measures.

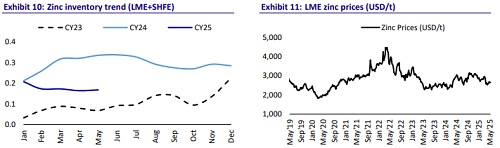

* We retain our earnings estimates for FY26-27E and expect HZL to maintain its focus on profitability. Additionally, the favorable pricing condition is likely to further support margins.

* At CMP, HZL trades at 8.5x FY27E EV/EBITDA, and we believe the current valuation prices in all positive factors. We reiterate our Neutral rating with a TP of INR480 (premised on 8.5x EV/EBITDA on FY27 estimates).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412