Buy Ambuja Cements Ltd for the Target Rs. 620 by Motilal Oswal Financial Services Ltd

Performance above estimates; long-term outlook intact

Reaches 100mtpa+ cement capacity mainly led by inorganic growth

* Ambuja Cements (ACEM) delivered better-than-estimated 4QFY25 results on lower cost (2% below estimate) and higher realization (3% above estimate). Consol. EBITDA increased 10% YoY to INR18.7b (vs. estimated INR14.4b), and EBITDA/t stood at INR1,001 vs. estimated INR752. Adjusted profit after MI was down ~16% YoY to INR4.5b (vs. estimated INR3.8b).

* The management reiterated that cost reduction guidance of INR500/t (incl. INR150-170/t achieved till now) by FY28E and aims to achieve EBITDA/t of INR1,500 by FY28E. ACEM’s capacity expansion plans remain on track, and it will have a cement capacity of 140mtpa by FY28E. Most of the capacity expansion in FY26 will be through organic routes, though management is not averse to inorganic plans.

* We incorporated Orient Cement into our financials from FY26. We believe that increasing the scale of operations along with cost-saving initiatives (lead distance reduction, higher green energy, etc.) will help profitability improvement. We would monitor ACEM’s earnings trajectory, as in the last few quarters, its EBITDA/t has been more volatile than its peers. The stock trades at 21x/16x FY26E/FY27E EV/EBITDA. We reiterate our BUY rating with a TP of INR620 (valuing the stock at 18x FY27E EV/EBITDA).

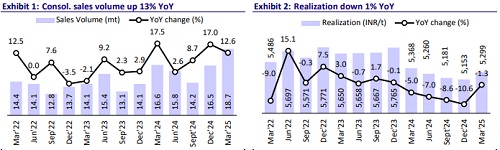

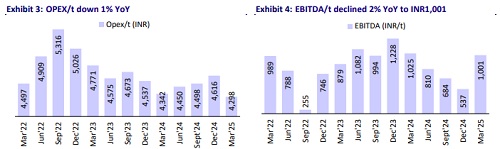

Consolidated volume up 13% YoY; opex/t down 1% YoY

* Consol. revenue/EBITDA/adj. PAT stood at INR98.9b/INR18.7b/INR4.5b (up 11%/up 10%/down 16% YoY, and in line/up 30%/18% vs. our estimate) in 4QFY25. Consol. sales volume rose ~13% YoY to 18.7mt (in line).

* Realization/t declined 1% YoY (up 3% QoQ). Opex/t was down ~1% YoY, led by ~2% decline each in variable costs/freight expenses. However, other expenses/t increased ~6% YoY. EBITDA/t declined ~2% YoY to INR1,001, and OPM was flat YoY at ~19% (est. ~15%).

* In FY25, revenue was up ~3% YoY, while adj. EBITDA/PAT declined 22%/36% YoY. Volume grew ~10% YoY to 65.2mt. EBITDA/t was down ~29% YoY to INR768. OPM dipped 4.6pp YoY to ~15%. OCF stood at INR22.4b vs INR56.5b in FY24. Capex stood at INR85.9b in FY25 vs. INR39.6b in FY24. Free cash outflow stood at INR63.5b vs. an FCF of INR16.9 in FY24.

Highlights from the management commentary

* Cement demand is estimated to grow between 6.5% and 7.0% in 4QFY25 (~4-5% YoY in FY25) and should improve ~8% YoY in FY26. Industry supply should clock ~6% CAGR, whereas demand should post 7.0-7.5% CAGR over the next few years.

* Cement prices improved between INR7 and INR10/bag in 4QFY25. The current price increase on average is better than in 4Q.

* Penna Cement is operating at 75-80% clinker capacity utilization, though grinding utilization is lower (60-75%). The exit-capacity utilization for Sanghi Industries was ~40-45%. Sanghi Industries’ acquired assets have not yet achieved the desired profitability, but it will be a clinker hub for the group with one of the best cost structures and clinker production costs

Valuation and view

* ACEM reiterated its capacity target of 140mtpa and EBITDA/t target of INR1,500 by FY28. Until now, capacity growth was largely driven by the inorganic route. However, the expansion will be largely organic in FY26, with multiple projects progressing across various locations. The company is also expected to prioritize the integration of acquired assets. Profitability improvement will be driven by ongoing cost-saving measures and a rising share of premium products.

* We incorporated Orient Cement into our financials from FY26. We estimate the company’s consol. revenue/EBITDA/PAT CAGR at ~17%/35%/36% over FY25-27. We estimate EBITDA/t to increase to INR900/INR1100 in FY26/FY27 vs. INR770 in FY25. ACEM (consol.) trades at 21x/16x FY26/FY27E EV/EBITDA. We reiterate our BUY rating with a TP of INR620 (valuing the stock at 18x FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412