Neutral Hindustan Zinc Ltd for the Target Rs. 510 by Motilal Oswal Financial Services Ltd

In-line performance led by favorable pricing

* Hindustan Zinc (HZ)’s revenue at INR85.5b (+4% YoY/+10% QoQ) remained largely in line with our est. of INR81b. The growth was driven by better commodity prices, offset by lower volumes.

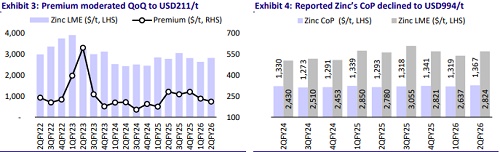

* EBITDA was also in line at INR44.5b (+7% YoY/+15% QoQ) during the quarter. EBITDA margin stood at 52% in 2QFY26 vs. 49.7% in 1QFY26 and 50% in 2QFY25. The improvement was primarily on account of favorable metal prices and lower cost of production.

* Zinc CoP for the quarter stood at USD994/t, which declined 7% YoY/2% QoQ due to softened input commodity prices and higher by-product realizations.

* HZ’s APAT stood at INR26.5b (+14% YoY/+19% QoQ) vs. our est. of INR25b in 2QFY26.

* In 1HFY26, HZ’s revenue remained flat YoY at INR163b, while both EBITDA and PAT increased 3% YoY to INR83/49b, respectively.

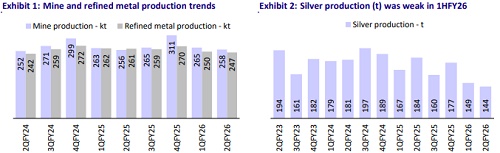

* Mined metal for the quarter stood at 258kt (+1% YoY/-3% QoQ), led by better mine metal grades and improved recoveries.

* Refined metal production for 2Q stood at 247kt. Refined zinc production was 202kt (+2% YoY/flat QoQ), while the refined lead production stood at 45kt (-29% YoY/-7% QoQ), due to lower pyro plant availability.

* Salable silver production declined 22% YoY and 4% QoQ to 144kt, in line with lower lead production.

Key management commentary

* The company revised the refined metal guidance to 1,075–1,000ktpa and silver output to 680t (±10t) for FY26, adjusting for plant availability and input performance in 1HFY26.

* HZ expects further cost improvement to USD950-975/t by 4QFY26, supported by higher renewable-energy usage and better ore grades.

* Renewable energy contributed 19% of total power in 2QFY26 and targets to reach 25% by FY26 end, which helps reduce power costs by about USD1.5/t for every 2% increase in renewable share. Coal mix stood at 52% in 1HFY26.

* By FY27, as the fumer plant and hot acid leaching units stabilize, silver output is likely to rise to 750-800tpa, reaching its long-term goal of 1,500tpa.

* The combined investment plan of INR160b includes INR120b for the 250ktpa integrated capacity expansion and INR38b for the zinc tailings project. Out of which ~20-25% of this capex will be incurred in FY26, 55– 60% in FY27, and the remainder in FY28.

* For FY26, management guided a growth capex of USD350-400m, covering all ongoing projects, including smelter debottlenecking, hot acid leaching for silver recovery, and new expansion initiatives.

Valuation and view

* The expansion plans are in line with the company’s long-term target of doubling its capacity. It also continues to focus on improving production with tight costcontrol measures.

* We cut our earnings estimates for FY26E on account of lower silver volume, while we maintain our FY27 estimates. Favorable pricing conditions (especially for silver) could support the margins further.

* At CMP, HZ trades at 8.8x FY27E EV/EBITDA, and we believe the current valuation prices in all the positive factors. We reiterate our Neutral rating with a TP of INR510 (premised on 8.5x EV/EBITDA on Sep’27 estimates).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412